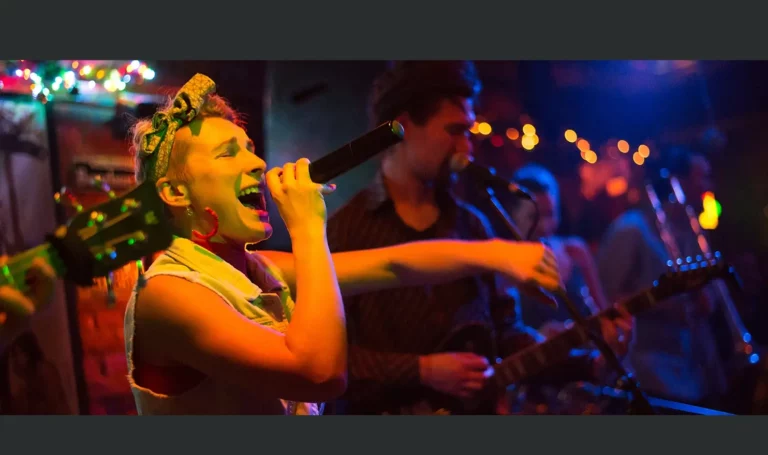

A musician’s world can be exciting. You get to meet people from all walks of life at gigs, connect with fellow musicians, and do what you enjoy.

There’s a lot of prep that goes into making a gig an outstanding success. You don’t want to forget anything. People depend on you to get the party started. The talent is one of the most important things needed at any event.

While you carefully make sure that preparation goes smoothly, have you thought about how you are protecting your business? Musicians insurance offers a layer of protection and financial security. There’s also so much more that it can do for you. Learn more about it below.

Gain A Financial Safety Net

Every musician’s nightmare is that something will go terribly wrong during a gig. It’s totally understandable too.

Once you realize what is happening, worry starts to creep in your mind. Could this incident be the end of your business? In some instances, legal action is the only solution.

With musicians insurance, you have coverage in place to respond to instances, such as legal action. General liability coverage is designed to cover fees you are legally liable to pay for and has a $2 million general liability limit. Coverage can serve as a financial safety net for your business.

Stand Out From Competitors

From paid advertising to word of mouth, there are many aspects to your marketing strategy. Fellow musicians in your area are pursuing the same avenues to get their name out there. The idea is to rise above the competition and fill your calendar with gigs.

What’s one thing you can do to stand out? Musicians insurance.

That was probably the last thing on your mind. Maybe it wasn’t even on your radar. Let us explain how coverage helps.

30% of our insureds have reported that having insurance has helped them get clients. With us, you have access to an insurance badge that can be used on your site. When potential clients see that you are insured, they may choose you over a competitor without it. You also have the option of featuring the insurance badge on business cards and other marketing materials.

Build Your Business

Venue owners usually require that musicians carry insurance. They also want to be included as an additional insured on their policy.

An additional insured is a person or organization (not an employee or a friend) that can be added to your insurance policy by endorsement. Your policy may protect that additional insured from claims arising out of your negligence.

At times, people pursuing legal action could possibly include the venue owner in the suit and try to get more money out of the ordeal. By including the venue owner, the musicians insurance policy extends to the owner since they weren’t at fault.

You can add unlimited additional insureds to your annual or event policy for $10 or $5 for one.

Protect Your Equipment

Speakers, microphones, instruments, and stands are the center of your business.

They do, however, run the risk of being damaged or stolen. Without these items, you can’t perform your job. Not the best thing for a musician! You can have inland marine protection in place to protect your gear.

Inland marine coverage is designed to protect movable items that are transported over land. This kind of coverage adds another layer of protection to your business.

Musicians Insurance from Insurance Canopy

So far, you have learned how insurance can serve you. Gaining a financial safety net, standing out from competitors, and protecting your equipment are only some of the benefits.

Consider Insurance Canopy for your insurance needs. We strive to make insurance easy for our customers. You can easily get coverage online and in minutes. Whether you need to update your policy, file a claim, or change your payment preferences, it can all be done through your customized dashboard.

Have a question about coverage? Our licensed agents are available to answer questions via chat, phone, or email. We are here to help!

We hope you found this information helpful!

Learn more about Musicians Insurance