How long do I need to keep my product liability insurance? It’s a question we don’t get asked often by our clients. The subject arises when someone wants to cancel their product liability insurance because they are:

- Selling their business

- Opening a new business

- Retiring

- Discontinuing a product line

What is important to understand is when one or more of these events occur, your product liability exposure does not go away. Just because you decide to get out of the business does not mean you won’t be sued if something goes wrong years down the road with the product you put into the market.

The question is if you are brought into a suit, will you have the resources to defend yourself and pay damages if necessary? If you cancel your product liability insurance policy, this is the position you may be in.

In this three-part series, we will provide information on items to be considered if you are contemplating canceling your product liability insurance. We will be covering:

- What policy coverage triggers are

- How an occurrence policy form works

- How a claims-made policy form works

- Discontinued products coverage

Our goal is to help you better understand the need to maintain your product liability insurance and the importance of recognizing the type of policy you have. So, let’s dive in!

Coverage Triggers

A “coverage trigger” is an event that must take place for the policy coverage to activate. One of the events that trigger coverage is when an “occurrence” takes place. The policies we will be discussing refer to the term “Occurrence”, which is defined as, “an accident, including continuous or repeated exposures to substantially the same general harmful conditions”.

The term “Occurrence”, as one of the coverage triggers, is used in both the Occurrence Form and Claims-Made Form policies. In addition, the policy definition of “Occurrence” is the same for both policy types. We will be primarily focusing on the Occurrence Form policy in this first series, but will refer to this definition again when discussing the Claims-Made Form.

Occurrence Form Policy

The Occurrence Form policy states, “We will pay those sums that the Insured becomes legally obligated to pay as damages because of “bodily injury” or “property damage” to which this insurance applies”. For the product liability policy to respond to a bodily injury or property damage claim, there are additional criteria that need to be met:

- The bodily injury or property damage is caused by an “occurrence” (accident) that takes place in the coverage territory

- The bodily injury or property damage occurs during the policy period (typically a 12-month period)

- No one knew about an “occurrence” or claim before the effective date of the policy

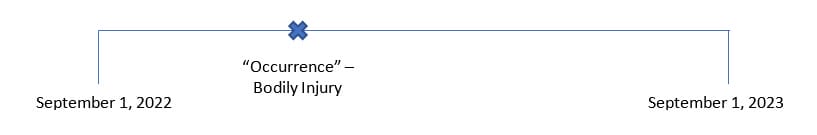

For example, if you are insured with “Company A” from September 1, 2022–September 1, 2023, and someone was injured from your product (an “occurrence”) on October 15, 2022, the policy would respond.

The policy would respond because you have a covered “occurrence” that happened during the policy period. The “Company A” policy would even respond to the covered “occurrence” that was not discovered until years later.

For Example, you have coverage through “Company A” from September 1, 2022–2023 then move to “Company B” from September 1, 2023–2024, and “Company C” from September 1, 2024–2025. While insured with “Company C” you are notified of a claim that occurred in October 2022. Because the claim (“occurrence”) happened during the “Company A” policy period, they would be the ones to respond to the claim.

Therefore, it is called an Occurrence Form policy because the insurance company that had the product liability policy in place at the time of the “occurrence” is the one that will be responsible for handling the claim.

Because of the functionality of the Occurrence Form policy, the reporting requirements are such to accommodate claims you are notified of at a later date. Some of the Occurrence Form policy claim reporting requirements are:

You must see to it that we are notified as soon as practicable of an “occurrence” or an offense which may result in a claim.

If a claim is made or “suit” is brought against any insured, you must:

(1) immediately record the specifics of the claim or “suit” and the date received; and

(2) notify us as soon as practicable.

You must see to it that we receive written notice of the claim or “suit” as soon as practicable.

Reference: ISO Commercial General Liability Policy CG0001 04/13 Pages 13 and 14 “Duties in the event of Occurrence, Offense, Claim or Suit

The reporting requirement on the Occurrence Form policy is, “as soon as practicable”. It is the most forgiving of the two product liability insurance policies.

To summarize the Occurrence Form trigger and claim reporting requirements:

- The “Occurrence” needs to happen during the policy period

- Claim reported, “as soon as practicable”

So How Does All This Affect You?

As a manufacturer, you may have produced and distributed products that have a long shelf life—like a ladder. I still own a ladder that I purchased 10 years ago. If you manufactured and sold 100,000 units in the lifetime of your business, that is a lot of potential liability exposure for you. If you chose to sell, retire, or pivot in a different direction, you need to decide how you are going to handle this exposure.

Remember the definition of an “occurrence” is an accident, including continuous or repeated exposures to substantially the same general harmful conditions. The date you manufactured the ladder—or any other product—does not constitute an “occurrence”. The date the product was produced is not the same date as the accident. So, just because you manufactured the product while you had product liability insurance does not mean it will be covered by the insurance policy you had in force at that time.

For example, you are insured from September 1, 2000–2022 with one or various insurance companies. For one reason or another, you decide to cancel your product liability insurance on September 1, 2022, so any claims or accidents that occur after September 1, 2022, may not be covered.

If this were the case, and I owned one of the ladders that were manufactured in 2015 and in October 2022 fell and became injured due to your faulty product there is no policy in force to respond to this “occurrence”. In this scenario, you could be faced with hundreds of thousands of dollars in legal fees, medical bills, and any other judgments against you.

Circling back to the original question how long do you need to keep your product liability insurance in force? The answer is you need to keep your product liability insurance policy in force if you have exposure to someone getting injured by your product.

If you are planning on pivoting and contemplating canceling your product liability insurance, you need to consult with your insurance professional to come up with options to maintain insurance coverage for your existing products—your exposure—that is still on the market.

If you have additional questions about the information provided or would like to speak to one of our licensed representatives, please contact us at 844.520.6993.

Disclaimer: All policies have specific coverage, limitations, exclusions, and conditions. Please refer to your policy for exact coverages. Also, time limitations of claims may be subject to specific state statutes of limitations and statutes of repose.