As you grow your business, part of your new sales strategy may include additional distribution channels through big box stores or e-commerce sites. As you entertain increasing your distribution footprint, these partner vendors may require you to make modifications to your product liability insurance policy, and limits, to protect them from potential claims.

Common Insurance Requirements

The most common product liability insurance requests from vendors are:

- Higher Liability Limits

- Additional Insured Status

- Primary and Non-Contributory Verbiage

- Waiver of Subrogation

So, why would a vendor require all these changes and additions to your policy? Because if someone is injured due to your product they are selling, they can be named in the lawsuit.

If this happens, the vendor wants you to provide, and pay for, defense costs, settlements, and judgments. This is called indemnification, and the general and product liability limits on your policy may help you cover these types of expenses.

Before entering into an agreement with a new vendor, you may want to ask for a sample contract. This way you can review the product liability insurance requirements and other indemnification sections.

Some requirements may increase costs to your business and may not be an equitable partnership. By reviewing these requirements beforehand, it can save you stress and money in the future.

Liability Limits

The most common limits we see on a general and product liability insurance policy are:

$1,000,000 Each Occurrence Limit

$2,000,000 General Aggregate Limit

$1,000,000 Products and Completed Operations Limit

$1,000,000 Personal and Advertising Injury Limit

$100,000 Damage to Rented Premises Limit

$5,000 Medical Payments

We will not address each of these limits at this time but rather focus on the Each Occurrence, General Aggregate, and Product Liability Limits.

- The “Each Occurrence Limit” is the most the policy will pay for a single claim. The insurance company will never pay more than $1,000,000 for any one claim arising from your operations or premises.

- “General Aggregate Limit” is the most the insurance company will pay for all claims in a policy period – usually 12 months.

- “Products and Completed Operations Limit” is your Product Liability limit. It is the most the insurance carrier will pay ($1,000,000 dollars) for a bodily injury or property damage claim arising from your product.

It is not uncommon to see a vendor require higher limits of liability. They can range from $2 million to $25 million in general and product liability limits, depending on your product. Sometimes to meet these requirements, you will need to get a separate umbrella or excess liability policy.

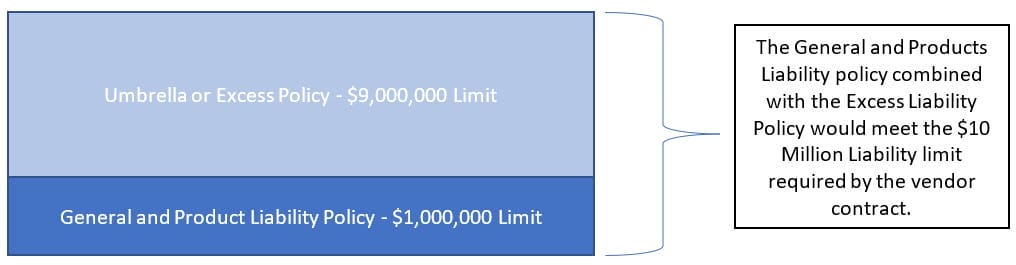

For example, you are working with a new vendor, and they require a $10,000,000 Each Occurrence limit on your policy. Your current policy only has a $1,000,000 Each Occurrence Limit, so you are $9 million short to satisfy the contractual insurance requirements.

The umbrella or excess liability policy will add an additional layer of liability limits to your general and products liability policy limits:

In some circumstances, the amount the vendor will sell would not offset the additional costs required by the contract. If this is the case, you could contact the vendor and try to renegotiate the liability limit requirements to reduce your costs and make the relationship more equitable.

Additional Insured

Most vendors will want to be named as an Additional Insured (AI) on your policy. This means they have access to your policy coverages and are protected in the case of a claim by your policy.

The vendor, as an additional insured, would receive coverage (including defense costs) for third-party claims and lawsuits the vendor is named in due to your negligence from your operations and/or your product. The AI is subject to the same general and product liability limits, policy limitations, exclusions, and conditions as you.

Some general and product liability policies automatically include the Additional Insured endorsement, but others may charge to add it to your policy. It is recommended you consult with your insurance agent to see if the Additional Insured endorsement is right for you, or if this would end up being an additional cost to your business.

Click, Quote, Covered.

Primary And Non-Contributory

General and product liability policies include an “Other Insurance” provision. Basically, this provision says that if there is another specific insurance policy that would respond to the same claim, that policy would be the “primary” policy and be the first to respond to the claim. The general and product liability policy you have in place would be secondary—or excess—on that claim.

When you add the Primary and Non-Contributory endorsement, you are taking the primary position (the first to respond) to the claim even if there is another specific policy in force that could respond first. With this endorsement, your general and product liability policy will be the primary policy to respond.

The Non-Contributory portion of the endorsement states that if there are two different policies that could respond to a claim, your insurance company will not seek contributions from any other policies in order to cover the claim.

There are laws that state if there are two policies in force it may require both insurance policies to contribute to the loss. But, if you have the Primary and Non-Contributory endorsement on the policy, your insurance policy will not seek any contribution for the claim from any other policies.

As with the Additional Insured endorsement, some general and product liability policies automatically include the Primary and Non-Contributory Endorsement. Yet in many cases, it may be an additional charge to add it to the policy.

Waiver Of Subrogation

Subrogation is a way the insurance company can recover claim costs from a third-party responsible for damages to you. When providing a waiver of subrogation, you waive the rights of your insurance carrier to seek compensation from the third party that caused those damages. In this case, you would be waiving the rights of your insurance company to subrogate (seek compensation) for claim payments and expenses from your vendor.

This endorsement may also be included in your policy, or it may be an additional cost to add it to your policy.

Stay Safe, Stay Insured

Through contracts, insurance requirements, and indemnification agreements, vendors are trying to isolate themselves from general and product liability claims from the product you sell.

In our litigious society, anyone who imported, manufactured, distributed, or sold a product that caused harm to another can be named in a lawsuit—so it’s best practice to try to protect all parties involved with a product. Vendors implement these requirements so if they are brought into a suit because of your product your insurance policy covers them.

If you have questions about the information provided, or have other insurance questions, please contact an Insurance Canopy representative at 844.520.6993. All policies have limitations, conditions, and exclusions. Please refer to your policy for exact coverages.