Product Liability Insurance

Product liability insurance with Insurance Canopy offers protection for your products — no matter where your business is in the supply chain. We understand your unique needs with customizable product liability insurance options and offer top-rated policies for an affordable price. With over a decade of experience, Insurance Canopy has helped over 10,000 businesses stay protected with product liability insurance.

What Is Product Liability Insurance?

Product liability insurance is a type of coverage designed to help businesses pay for third party bodily injuries and property damages caused by faulty products they sell, manufacture, or distribute.

While it’s not typically required by law, it’s considered best practice for anyone involved in the manufacturing, distributing, or selling of a product to be insured.

Product liability insurance offers the insured person or business three specific benefits: it decreases the personal risk involved with doing business, covers the cost of claims and lawsuits, and helps your business meet the insurance requirements placed upon it by outside organizations.

1. Product Liability Insurance Lowers Your Risks

If your business is involved in the manufacturing, distribution, or selling of a defective product, you can legally be held liable for whatever damage or injuries that product may cause. This is known as product liability. As a business owner, it’s your job to be aware of these risks and your responsibility to manage them.

Product liability is the legal precedent for those in the supply chain to be held liable in cases where third-party accidents are caused by a defective product. These negligent accidents are generally categorized as bodily injuries and property damage.

For example, a consumer may cut their hand on a broken piece of a product. Or, a faulty lid may cause a product to leak and ruin the consumer’s cupboard the product was in.

While there’s a wide range of defective product risks, most claims typically fall into one of the three product liability categories:

- Manufacturing defects: An error or flaw was introduced, whether intentionally or not, during the manufacturing of the product, causing it not to function as intended.

- Design defects: During the planning phase, insufficient care was given to the design of the product, causing it to be faulty, unreliable, or unfit for use.

- Missing or incorrect warnings, instructions, & labels: Directions for using the product were either not included or were inadequate, resulting in a consumer using the product in an unintended way.

These product liability risks are often associated with strict liability, meaning your business can be held liable for product-related accidents regardless of your intent or knowledge of the risks.

If your business plays a part in the supply chain of a product—whether it be in sales, distribution, installation, or manufacturing—you can be liable for a product liability claim and named in a lawsuit.

Product insurance, also called product defect insurance, protects you against the repercussions of your involvement with a defective product—allowing your business to be prepared to handle a claim whether you knew about a risk or not.

2. Product Liability Insurance Covers Claim & Lawsuit Expenses

Product liability lawsuits are known to be expensive, even if you are not liable for the defects causing injuries or damages.

In recent years, a business named in a product liability case can expect to pay an average of $712,916 on defense costs alone. With an average jury payout of $1,479,368, a single claim can cost a business millions.

Product liability insurance is designed to help businesses pay for these types of third-party expenses, including:

- Medical care

- Legal costs

- Lost wages

- Property repairs

3. Product Liability Insurance Meets Industry Requirements

Although product liability insurance is not compulsory under US law, other companies or regulating bodies may require it as a precursor to doing business. At all points in the supply chain, your business may be asked to show proof of insurance. It’s most likely to come up in contracts, partnership agreements, and retail requirements.

This helps other businesses protect themselves from potential risks and lawsuits that may stem from your products and operations.

For example, a manufacturer may want proof of business product liability insurance before producing a product you designed. Or, a retailer may require you carry product insurance before selling your product.

The Importance Of Product Liability Insurance For Small Businesses

We live in a litigious society, and the need to protect your business and assets from potential lawsuits is of growing importance. Having the right business product liability insurance creates a financial safety net so you can be prepared when the unexpected occurs.

Small businesses have very limited options when trying to obtain product liability insurance for a home business through home and renters’ insurance policies. Plus, many e-commerce sites are now starting to require online sellers to carry their own coverage. You also might have contracts, leases, and professional licenses requiring you to purchase insurance.

Who Needs Product Liability Insurance?

Any business that imports, produces, distributes, or sells products needs product liability insurance. While there are no laws legally requiring you to carry insurance in order to run your business, you’ll find you need insurance in order to do business.

Many clients, landlords, retailers, and marketplaces require you to have insurance before they will consider working with you. Businesses that forgo insurance can lose out on key partnerships or risk breaking contractual agreements.

This is because no one wants to carry the risk of paying for a product liability claim. A single claim may lead to product recalls, a damaged reputation, millions in awards and legal fees, and possible loss of a business.

If you’re a manufacturer, importer, wholesaler, distributor, retailer, or online seller of a product, you face the risk of being named responsible in a product liability lawsuit.

Any individual or business that turns raw materials into finished goods is considered a manufacturer. Every product you put into the market or in the hands of the consumer brings additional exposure to your company.

Anyone, or anything, that is injured or damaged because of your products can file a claim or lawsuit against you and your company for those damages.

Examples of claims a manufacturer might face include:

- Sickness from food

- Fire due to faulty batteries

- Injury due to missing safeguards

- Burns caused by defective design

- Injury from inadequate instructions or safety warnings

These are the types of claims and lawsuits that your product liability insurance can respond to.

An importer is a person or business bringing goods into the country from other countries. In most cases, insurance companies label importing businesses as manufacturers. This is because you are responsible for a defective or damaged product being placed on the market in a new location.

If an importer brings goods in from China and someone is injured from those products, the injured party cannot sue the China manufacturer. They will sue the importer because they brought the product in.

Product insurance can cover injuries and damages caused by the products you import into the country.

Distributors work as a liaison between manufacturers and wholesalers. They take goods produced by manufacturers and find wholesalers to sell the products. Wholesalers will then sell their products to retailers or direct to consumers in bulk at a discounted rate.

Wholesalers and distributors play an important role in the supply chain of products. Although they are not physically importing or manufacturing the product being ordered or distributed, they still have a product liability exposure.

In our litigious society, if a person is injured by a product they will typically name everyone in the supply chain. Although the injury may not be your fault, the cost to defend and get you out of a claim can be substantial.

Products liability coverage is designed to respond to claims and lawsuits that arise to products you have manufactured, sold, handled, or distributed by you.

Online sellers commonly distribute products through their personal ecommerce platform or through other platforms such as Amazon, eBay, or Etsy. Although you may not have some of the same exposures as a retail store—such as slip-and-falls accidents—there are many common product liability exposures you share.

Many online sellers are re-selling products made and imported from other businesses. However, your business is the one consumers are coming in direct contact with to receive these products. That makes any product liability risks your responsibility. The same goes for online sellers who sell items they produce themselves.

Even if you are found to have no fault in a product causing damages or injuries to a consumer, the cost of legal fees alone can be detrimental to your online business. It can also affect your standing with any online marketplaces you sell through, putting you at risk of having your storefront shut down.

Product liability insurance can help you cover the cost of lawsuits or claims your online retail business may face.

As a retailer you sell goods to the public that have been typically acquired from a wholesaler or distributor. Most retailers do not think they have a product liability exposure because they are only selling products that have been manufactured or imported by someone else.

However, retailers are considered part of the supply chain. Thus they can be held liable in product liability claims, and can be named in lawsuits.

If someone is injured or something is damaged from a product you sold, you are more than likely to be named in the lawsuit along with the wholesaler, distributor, manufacturer, and importer. While you may not be found liable for the injuries or damages, the cost you’ll have to pay to exit out of the lawsuit or claim can be significant.

Product liability insurance can help cover these costs—and in the event that you’re found liable, it could help pay for damages too.

What Does Product Liability Insurance Cover?

- Injuries (such as burns, choking, allergic reactions, cuts, & bruises)

- Illnesses & infections (including viruses, bacteria, fungi, parasites, & foodborne germs)

- Death or dismemberment (including paralyzation)

- Property damage (such as fires, discoloration, leaks, stains, & cracks)

- Legal fees

- Medical bills

- Lost wages

- Repairs

- Replacement costs

- Funeral expenses

Although it may be unlikely that you’ll be party to a lawsuit, accidents are unpredictable. Even if you have strict product testing and carefully monitor product safety, mistakes, oversights, and mishaps can still occur causing people to get hurt.

Having product liability insurance provides peace of mind and protection against times like these. It can help you reduce the costs associated with product liability claims and keep business operations running smoothly.

Additional Coverages With Product Liability Insurance

You’ll often find product insurance is a coverage not sold by itself—it’s typically found in general liability policies and comes with other additional coverages.

You may find General Liability Insurance, Completed Operations, Personal & Advertising Injury, Medical Expense Limits, and Coverage for Damage to Premises Rented to You are often included with products liability coverage.

- Product Recall Insurance — This may help cover the cost of removing your product from the market if the situation calls for a mass recall, including shipping costs. It does not include the cost of lost revenue or issuing refunds.

- Inland Marine Insurance — This covers your tools, equipment, and inventory while in transit over land.

- Professional Liability Insurance (Errors & Omissions) — This covers injuries or damages caused by professional advice you did or did not give. For example, if you advise consumers to use your product in a way that causes a spike in injuries, you can be held responsible. Or, if your instructions fail to clarify the recommended use of a product, you are liable for any accidents that occur.

- Cyber Liability Insurance — This covers the cost of stolen funds, business information, or private customer information taken during a cyber attack or phishing scam.

- Hired/Non-Owned Auto Coverage — This covers rented, leased, or borrowed vehicles used for business purposes.

- Workers’ Compensation — This covers illnesses and injuries (including death) an employee of yours may sustain while on the job.

- Trade Show Coverage — This covers your business from claims that may stem from incidents that occur while attending events or trade shows. For example, an individual tripping in your booth or unexpected weather conditions blowing your tent into another booth.

- Additional Insureds — This covers other businesses requiring additional insured status on your policy. An additional insured may be a landlord, business, city, location, or partnering business. It is not yourself, employees, family, or friends.

- Employee Benefits Liability — This covers errors and omissions while administering employee benefit plans.

These types of coverages are known as endorsements and are designed to be “add-on’s” to your policy.

What Does Product Liability Insurance Not Cover?

Product liability insurance can only cover so much—third-party injuries and damages are the extent this single policy can insure your business for. That’s why many policies have additional coverages and endorsements to widen your protections.

Depending on which company you purchase your policy from, as well as other factors, the scope of products liability coverage for your specific policy can vary. It’s important to refer to your policy documents and discuss the coverages with an insurance professional for exact coverages within your policy.

While you may be able to add the following as endorsements, they may be considered exposures not covered under your product liability insurance policy:

- Product Recall Insurance Product recall insurance covers expenses associated with recalling a product from the market. Product recall insurance is typically purchased by manufacturers such as food, beverage, toy, and electronics companies to cover costs such as customer notification, shipping costs, and disposal costs. This is an optional endorsement and is described in further detail above.

- Discontinued Products Coverage: Discontinued Products Coverage is meant to cover third party injuries or damages that may occur with a product no longer in production. Suppose you discontinue a product line and replace it with newer technology. The discontinued products may stay in the hands of consumers for years, and the risks associated with them would still lie with your business. This coverage protects your assets even after business operations have ceased and former business insurance policies have ended.

- Damaged & Stolen Products or Property Insurance Property insurance helps cover the damage or loss of your property, like structures or buildings, and items including equipment, furniture, inventory, supplies and fixtures. It can also help cover the costs to repair or replace stolen, damaged or destroyed property.

- Workers Comp Insurance: Workers comp can protect your business and your employees by helping cover missed wages, medical expenses, vocational rehabilitation and death benefits occurring from a work related injury. If you have employees, you are subject to the workers compensation laws of your state.

- Cyber Liability & Data Breach Coverage: Cyber Liability Insurance covers a business' liability for a data breach where there is a loss of private customer or business information, or business funds. It may cover a variety of expenses associated with data breaches, including: data retrieval, lost funds, cyber extortion, notification costs, credit monitoring, costs to defend claims by state regulators, fines and penalties, and loss resulting from identity theft.

- Auto Insurance: Certain business usage and vehicle types may be excluded from personal auto insurance policies. Auto Insurance covers many types of commercial vehicles and automobiles used for business purposes—including company cars and commercial trucks.

- Land & Sea Shipping Coverage: Insurance covering the transportation of goods and/or merchandise by vessels crossing both foreign and domestic waters—including any inland or aviation transit associated with the shipment. A typical Inland Marine coverage only insures transportation over domestic land, so this coverage offers additional protection.

Other lines of insurance coverage should be considered to complement your product insurance and address other exposures your business may have. If you have any questions or concerns about finding coverage for your product, our experienced agents can help assist you and see if we have a policy for you.

Does General Liability Insurance Include Product Liability Insurance?

The short answer is yes—unless specifically excluded, a general liability insurance policy will usually cover certain product liability-related claims. However, coverage for such claims may not be as thorough as a product liability-specific policy.

This is why a policy that includes both general and product liability insurance is the most effective way to ensure you are protected against both types of claims.

A general liability policy will respond to bodily injury and property damage claims from other areas of your business operations. It often covers premises liability, completed operations, personal and advertising injury, damage to rented premises, and in some cases, product defect coverage.

If your general liability policy includes product liability insurance, it often comes with restrictions in what is covered. It is important to review any product liability restrictions, if any, with an insurance professional and review the products covered periodically.

Product liability, or product-specific, policies are designed to respond to bodily injury and property damage claims arising from the use of your products. Many policies may not have restrictions on the products you sell, but it is very common for a product liability policy to only provide coverage for specific products you sell.

If this is the case, you are required to provide a list of products you want to be covered by the insurance company and have them listed on the policy. If it’s not listed, it’s not covered.

For example, if you have a product liability policy listing baseball gloves, bats, and baseballs the policy would only respond to claims arising from these specifically listed products. So, if you had a claim arise from a batting helmet, which is not listed on the policy, there would be no coverage.

This type of product liability policy can be problematic, as you may forget to report to the insurance company additional product offerings your business adds during the year. If you have a product liability policy with this restriction, it is important to review your “insured product” list regularly to make sure it’s up to date.

When available, we strongly suggest purchasing a comprehensive general liability policy that includes product liability over a product-specific policy. This will provide your business with a policy offering broader coverages to protect your business.

How Much Does Product Liability Insurance Cost?

On average, product liability insurance costs between $800-$1400 per year. However, the total premium amount you end up paying depends on how much risk your business carries.

According to our own research, more than 50% of our customers pay less than $1,400 for their annual premiums.

Additionally:

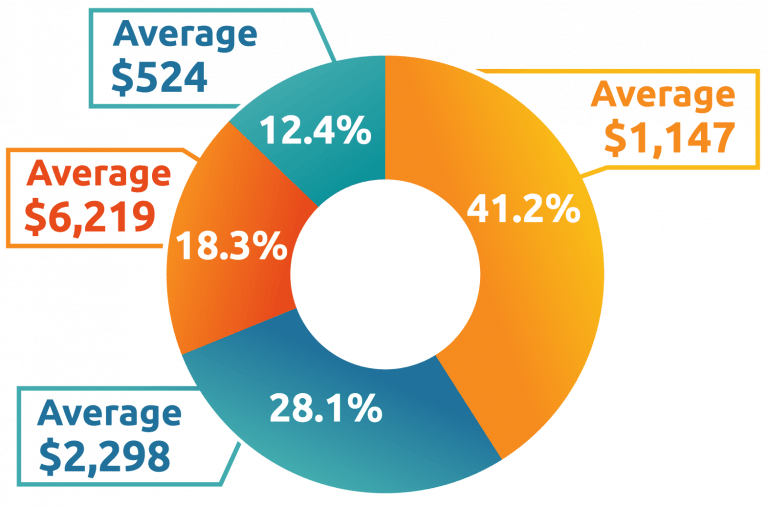

- 41.2% of customers pay an average of $1,147 in annual premiums

- 28.1% of customers pay an average of $2,298 in annual premiums

- 18.3% of customers pay an average of $6,219 in annual premiums

- 12.4% of customers pay an average of $524 in annual premiums

No two businesses are exactly alike, making every insurance policy unique. Your product liability insurance rate is going to be specifically tailored to your business and the products you want to insure.

When you apply to get a product liability insurance quote, consideration is given to multiple factors before a final cost can be calculated. These are going to vary depending business to business, so it’s important you provide your agent with all the information they need to make your quote.

Factors that could affect the cost of your product liability insurance premiums include:

- Annual sales

- Limits & coverages

- Class codes

- Claims history

- Industry

- Product type

- Business size

- Contract requirements

Industry

Some businesses have risker operations than others. For example, insurance companies classify manufacturers as a higher risk business than an online seller.

Product Type

High risk products may require higher insurance limits because they are more likely to lead to injuries or damages. These products are typically items such as safety gear, medical equipment, and industrial products.

Business Size

Where you work and who you employ impact coverage needs. Home-based businesses run by a single person carry less risk and lower premiums, whereas a business storing products in a 10,000-square-foot warehouse will have more risks and higher premiums. Most states legally require businesses with at least one employee to carry workers’ compensation, which is an additional expense you should plan for. Carrying workers’ comp will only impact your overall business insurance costs and not your product insurance costs.

Contract Requirements

It is commonplace for Amazon sellers, big box stores, landlords, or other third parties to have insurance requirements in their contracts. You may have to pay more to raise your limits or add additional coverages to your plan in order to meet these contract requirements.

As discussed under Contract Requirements, you may be required to have certain limits and coverages. The industry standard is a $1 million per occurrence limit with a $2 million general aggregate limit. Raising limits and adding coverage (also known as endorsements) will raise your premium.

A class code is how an insurance carrier categorizes your business. This is used to measure your risks and calculate your premium. If you are not classified correctly on policy, you could be overpaying for insurance or not receiving adequate coverage. It is important to discuss how the agent is classifying your business.

Past claims can put you at high risk and impact your limits. Businesses who have filed claims for product injuries or damages will have higher premiums than those who have never filed a claim. If someone is repeatedly negligent, then they are more likely to have another incident happen—making them a high risk policyholder.

Public & Product Liability Insurance Coverage

Public liability insurance helps a business cover medical expenses, legal fees, and repair costs for third-party injuries and damages. However, the term “public liability” is outdated and uncommon. It is not a term insurance companies use anymore.

Essentially, public liability is general liability. It’s intended to protect you against injuries or damages arising from your business operations. What this means is if someone is hurt or their property is damaged on your premises, this coverage would help you pay for the claim.

For example, an inspector is visiting your manufacturing plant. While there, they trip over an uneven surface and break their ankle. Or, a group of investors is visiting your distribution center. A container accidentally tips over and sprays a liquid that stains their business clothes.

You may occasionally see the term public liability being used in a contract by a landlord or business. These contracts are not regulated by insurance companies, so we often cannot control the terms you will see published in them. Because the writers of these contracts aren’t insurance industry experts, mistakes like this can occur.

Just know if you ever see the term “public liability insurance” being used, you won’t find an insurance company selling a policy under the same name. You can look for general liability insurance instead.

Insurance Canopy’s general and product liability policy can help you meet “public liability and product liability” insurance requirements you may be trying to fulfill. Our insurance professionals can help you clarify what kind of insurance you need and how to purchase it.

Tips For Buying Product Liability Insurance

When it comes to buying a product liability insurance policy, you typically have to go through an agent. And not all agents are created equal. Each will have their strengths in areas that others will not.

As with any other professional field, you’ll want to look for individuals with specialties that align with your needs. Working with someone who has both a strong knowledge of product liability insurance as well as insurance carrier relationships—or specialized programs—is essential.

Your agent’s responsibility is to understand and evaluate your exposures so they can suggest coverages to meet your needs. You’ll need to meet with your agent to discuss your business operations, your product, where it’s manufactured, the ingredients, the end user, and distribution channels.

Tell them about your short-, mid-, and long-term goals. Talk to them about your plans for new products or discontinued products and the timing of these products. The more your agent is informed about your business; the more options can be provided. Your agent should be your advocate.

- Ask whether product liability insurance a key industry they serve

- The correct insurance classification for your business

- What your estimated gross sales is and how to calculate that number

- Limits of insurance

- If your policy fulfills the insurance requirements you have in a contract

- Whether you have foreign exposure, meaning you sell products outside the United States

- Timing to get quotes. When can you expect to hear back from them?

- Insurance carriers they will be approaching

- Whether they have any special programs catering to manufacturers, importers, and distributors

If you are not having an open dialogue with your agent, it is time to start. It will help avoid pitfalls in the future as your business expands and additional products are offered. When communicating with your insurance professional, it is always easier to make better-informed decisions.

Start Your Search for Product Liability Insurance Early

When we say “early,” we are talking about starting to look within 90 days of the date you will need to get the policy in force. We understand that many start-ups and new ventures may be creating a business plan and need to budget for their product liability insurance. The dilemma is that if you get quotes too early in the process, they may not be valid by the time you need the coverage.

Many product liability insurance carriers will put an expiration date on their quote; typically this is 30 days. If a quote is older than 30 days, the underwriter can:

- Refresh the quote

- Re-underwrite the exposure

- Require a new application

- Change premium from the original quote

- Decline to quote the risk

When requesting a quote, let your agent know where you are in the process of your business and provide anticipated start dates for your coverage. This is also an opportune time to discuss business and/or product strategies that may be in the ideation phase but could impact the eligibility of your product liability insurance.

If your agent advises against getting a formal quote from the insurance carriers, they may be able to provide you with an indication, an estimate of what the insurance may cost.

Is it mandatory that you give an agent 90 days to quote? No. We have turned the quote around and put coverage in place the same day, but it can be challenging.

To reduce stress levels and any surprises during the underwriting process, the more time, the better. Most small businesses shop or renew their product liability policies 10-15 days before their policy expiration or open date.

Related Articles

How to Become a Personal Trainer in North Carolina

Becoming a personal trainer is a rewarding career path for health and fitness

Understanding the Drivers of Product Liability Insurance Costs

Trying to navigate the roads of product liability insurance can feel like navigating

Best Product Liability Insurance Options

Find the best product liability insurance option for your needs and get a