Your business deserves the best protection, and understanding your cleaning business insurance policy is the first step. This quick guide simplifies the most important aspects of your coverage, helping you avoid costly mistakes and ensuring you’re fully protected when you need it most.

Key Terms You Need to Know

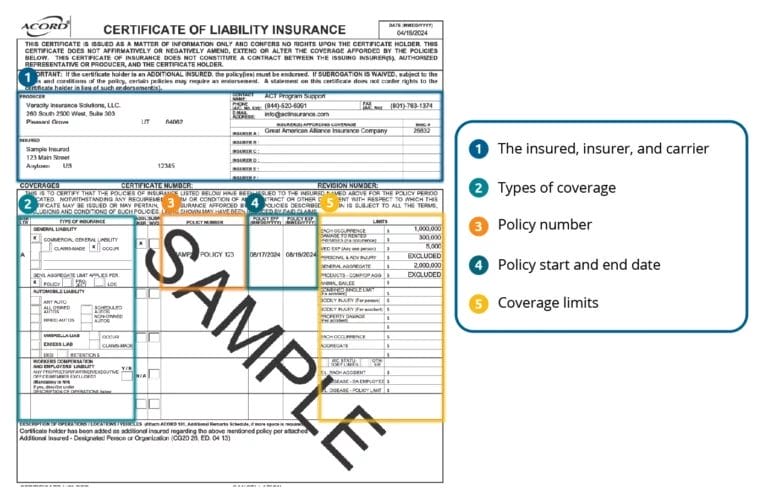

Insurance policies can be filled with industry jargon — we hate that as much as you do! We’ve made it our mission to demystify insurance and help you get familiar with the most important terms in your Certificate of Insurance (COI) and what they mean in plain language.

Terms you may want to familiarize yourself with include:

- Liability: Your legal responsibility if a third party is injured or their property is damaged because of your work.

- Claim: A request to your insurance provider for financial coverage after an incident.

- Premium: The amount you pay for your insurance policy, usually monthly or annually.

- Deductible: The amount you must pay out of pocket before your insurance covers the rest of a claim.

- Policyholder: You, the business owner who holds the insurance policy.

- Policy period: When your policy is active and provides coverage.

- Occurrence coverage limit: The maximum amount your insurance will pay for a claim.

- Aggregate coverage limit: The maximum amount insurance will pay in a policy term (e.g., a 12-month policy, 1-3 day event policy, etc.)

- Excess/additional coverage: Extra protection you can add to your policy for specific risks.

- Exclusions: Situations or damages that your policy does not cover.

- Endorsement: A change or addition to your insurance policy that modifies coverage.

- Pro-tip: You can use your COI as a marketing tool by showcasing it on your website, in proposals, or on social media to build trust and attract more clients.

Need more info? Check out our insurance glossary to learn more.

What’s Covered in Your Policy

Your cleaning business insurance policy provides protection against common risks that could otherwise cost you thousands of dollars. The base policy is a general liability policy, and from there you can customize your coverage with add-ons to bundle more robust protection that is tailored to your business.

General Liability Insurance

General liability insurance protects you when your business is responsible for third-party injuries or property damage.

Example: Your employee accidentally spills a cleaning solution on a client’s expensive hardwood floor, causing $8,000 in damage.

- Your general liability insurance is designed to cover property damage claims.

- If your policy has a $1 million coverage limit, the $8,000 claim is well within coverage.

- If you have a $500 deductible, you pay that amount first, and your insurance covers the remaining $7,500.

Without coverage, you’d have to pay the full $8,000 out of pocket.

Add-Ons

Got extra coverage? Take a closer look at the most popular add-ons.

Tools and Equipment Insurance

Also known as inland marine insurance, this coverage helps replace or repair essential cleaning tools if they’re stolen or damaged.

Example: Your van is broken into, and $3,000 worth of commercial vacuums and cleaning supplies are stolen.

- If you have tools and equipment insurance with a $5,000 coverage limit, your loss would be fully covered.

- If your deductible is $250, you pay that amount, and insurance covers the remaining $2,750.

Without this coverage, you’d have to buy new equipment out of pocket, which could strain your budget.

Workers Compensation Insurance

Workers compensation covers medical bills and lost wages if one of your employees sustains a work-related injury or illness.

Example: Your employee slips on a wet floor while mopping an office space and suffers a back injury, requiring medical treatment and two weeks off work.

- Medical expenses total $7,000, and lost wages amount to $1,800.

- Workers compensation covers both, meaning you don’t have to pay out of pocket.

Without this coverage, you could be legally responsible for paying for your employee’s medical bills and lost wages.

Commercial Auto Insurance

If you use a vehicle for your cleaning business, a commercial auto policy covers accidents, theft, and damage.

Example: You rear-end another vehicle while driving to a client’s home, causing $4,500 in vehicle repairs for the other driver and $2,000 in damage to your own van.

- If your commercial auto policy includes liability and collision coverage, insurance pays for the other driver’s damages and your own vehicle repairs.

Without this coverage, you’d be responsible for both repair costs.

Cyber Liability Insurance

Cyber liability covers financial losses due to hacking, data breaches, or cyber fraud.

Example: Hackers access your business computer and steal payment info from 50 clients, leading to $15,000 in legal fees and client compensation.

- Your cyber liability policy with a $50,000 coverage limit would cover the full amount after your $1,000 deductible is paid.

Without this, you’d be responsible for legal fees and damages, which could hurt your business reputation as well as its finances.

Janitorial Service Bond

A janitorial service bond reimburses clients if an employee is accused of stealing while on the job.

Example: A client accuses your employee of stealing a $2,500 watch, and your janitorial bond pays the claim.

- If the claim is verified, the bond provider reimburses the client, keeping your business reputation intact.

- Some policies require you to reimburse the bond amount over time.

Without a janitorial service bond, the client might sue you for damages, leading to legal fees and potential business loss.

What’s NOT Covered in Your Cleaning Business Insurance

Your policy covers a lot, but not everything. Read your policy for a full list of exclusions, which will include items like these:

- Exterior work over three stories

- Subcontractor issues: If you hire subcontractors but don’t have the right protections in place, you could be taking on their risks. For example:

- A subcontractor damages a client’s property, but you don’t have a contract stating they’re responsible — now you’re on the hook.

- They don’t have enough insurance, and a claim falls on your policy instead of theirs.

- You weren’t added to their policy, so their coverage doesn’t extend to you when something goes wrong.

- Tainted drywall, flooring, and similar products

- Condominium, townhouse, or tract home construction projects

- Exterior insulation and finish systems

- Shifting or sinking of land

- New York construction or contracting

- Metal gas, fume, and metal by-products

- Unmanned aircraft

- Damage to work performed by sub-contractors

- Operations or work involving scaffolding

- Insurance claim response, water removal/extraction, mold remediation, fire, smoke, flood, or other disaster services

- Operations involving construction debris removal

Tip: Insurance exclusions often overlap with legal blind spots that can quietly put your business at risk. Before you assume you’re fully covered, check out legal red flags that could derail your cleaning business.

Cleaning Business Insurance Coverage Limits

Your coverage limits show the maximum amount your policy will pay out for different types of claims, giving you confidence that your business is well-covered in case of an accident or damage.

Maximum Cleaning Liability Insurance Limits

General Aggregate | $2,000,000 |

Products & Completed Operations Aggregate | $2,000,000 |

Each Occurrence Limit | $1,000,000 |

Personal & Advertising Injury Limit | $1,000,000 |

Damage to Rented Premises Limit | $100,000 |

Medical Expense Limit | $5,000 |

Tools & Equipment Coverage

Limits / Occurrence / Aggregate | Premium | Deductible |

$1,000 / $3,000 | $40 | $250 |

$2,000 / $6,000 | $55 | |

$5,000 / $10,000 | $60 |

Coverage Limit Definitions

To help you fully understand your cleaning insurance policy, here are more detailed explanations of the charts above.

- Aggregate: The total amount your policy will pay for all covered claims during the policy period.

- Occurrence: A single event that results in a claim, such as property damage or injury.

- Each occurrence limit: The maximum amount your policy pays for a single claim. (Example: You accidentally damage a client’s furniture while cleaning.)

- Products & completed operations aggregate limit: The total coverage for claims related to your completed work or products you’ve used. (Example: A cleaning solution you used causes damage to a client’s hardwood floors after the job is done.)

- Personal & advertising injury limit: Covers claims related to things like defamation, slander, advertising mistakes, or copyright issues. (Example: A competitor sues you over an ad that suggests their company isn’t trustworthy.)

- Damage to rented premises limit: Covers fire or other specified damage to a rented business space. (Example: An electrical fire damages the office space you rent.)

- Medical expense limit: No-fault coverage to pay small medical bills, so no lawsuit is required. (Example: A third party trips over your vacuum cord and needs $1,500 in medical care.)

- Premium: The amount you pay for your insurance policy, either monthly or annually.

- Deductible: The amount you must pay out of pocket before your insurance covers a claim.

How to File a Claim with Insurance Canopy

The cleaning insurance claims process can take anywhere from a few weeks to a few months, depending on the situation.

- Report the incident: If the situation involves authorities (like theft or injury), file a police report right away. Make sure to document everything — date, time, location, photos of damages, any injuries, and keep copies of all communication.

- Gather your documents: Before filing, make sure you have all the necessary paperwork, like your insurance policy details, receipts for damaged or stolen equipment, and a written account of what happened.

- Submit your claim online: Filing a claim with Insurance Canopy is easy. Just log in to your account, go to “Manage Policies,” click “File A Claim,” and complete the form. It’s quick and can be done in just a few minutes.

- Follow up: After you submit, a claims adjuster will contact you within 24-48 hours. Be ready to provide any additional information they may need, like photos or receipts.

If you need help at any point, Insurance Canopy is here to guide you through the process of filing a claim.

How to Review, Renew, and Update Your Policy

Manage your Insurance Canopy policy with ease in your online dashboard or with help from our team of non-commissioned customer service reps:

- How to review your policy: Review your policy anytime online in your dashboard. You’ll find your insurance policy details and Certificate of Insurance (COI) right there!

- How to renew your policy: Your policy will renew automatically to keep you protected unless you opt to manually renew. Either way, you’ll get email reminders — so there are no surprises!

- How to update your policy: You can update your policy (whether it’s adding coverage, changing your business details, or adjusting limits, etc.) through your customer dashboard.

For more complex changes or assistance managing your policy, feel free to go over our cleaning business FAQs or contact our support team — we’ll guide you through the process.

FAQs About Cleaning Business Insurance

How long does it take to process a claim?

Processing times vary depending on the complexity of the claim, the legal process, and more. Simple claims may take just a few weeks to months, while more complex claims could take longer.

Can I cancel my policy at any time?

At Insurance Canopy, our policies are fully earned once your coverage begins, so they are generally non-refundable. You can cancel your insurance at any time through your online dashboard. Be sure to check your policy terms for refund eligibility to ensure a smooth process.

What if I don't understand a term or section of my policy?

Don’t worry! Your insurance provider is here to help. Reach out to us for clarification on any unclear terms or sections of your policy.

Clean with Confidence — Get Covered Today!

From reviewing your policy to updating coverage or filing a claim, we’re here to make the process simple and straightforward. Get in touch today to review your coverage or make any necessary updates; we’ve got you covered!