You’re in people’s homes or businesses every day, scrubbing, dusting, and making everything shine. But what happens when things go wrong? Say you’re cleaning a client’s high-end kitchen, and oops! — you spill bleach on their brand-new rug. These aren’t just awkward moments; they can hit your wallet hard.

If you’re self-employed and something like this happens, you’re on your own when it comes to covering these costs. Cleaning insurance is your safety net, keeping you protected so you can focus on what you do best — leaving spaces sparkling clean.

See why cleaning insurance is a must, what types of coverage you need, and how much cleaning insurance for self-employed professionals costs.

Do Self-Employed Cleaners Need Insurance?

Absolutely! Self-employed cleaners step into someone else’s world every day. You work hard to make things spotless, but let’s be real: things don’t always go as planned. You work in spaces full of valuable belongings, slippery surfaces, and the occasional unpredictable client. Even if you’re meticulous, accidents can happen.

What if…

- You spill cleaning solution on a client’s brand-new couch

The result? A costly replacement or repair bill that could eat into your profits — and potentially harm your reputation. - Someone trips over your vacuum cord and ends up in the ER

You could be on the hook for their medical bills and even face a lawsuit, putting your finances and business at serious risk. - You accidentally knock over a valuable item, like a crystal vase or a piece of art

You’ll likely need to pay for the damages, which could range from hundreds to thousands of dollars.

These aren’t just inconveniences — they’re expensive, stressful situations that can derail your business. Without the right self-employed cleaner insurance, you’re left vulnerable to financial loss and potential legal trouble.

Is It Required By Law?

The short answer? It depends, since laws vary state to state. But in some cases, certain types of insurance are required by law — especially if you have employees or work in high-risk environments.

Here’s what’s legally required for self-employed cleaners:

- Texas: No law requiring cleaning insurance for self-employed professionals, but many clients will ask for proof of insurance before hiring. Having coverage can help you land bigger jobs. Check out cleaning business insurance in Texas.

- California: If you have even one employee, workers compensation insurance is required by law under California Labor Code Section 3700. Find out more about cleaning business insurance in California.

- Florida: Cleaning businesses with four or more employees must carry workers compensation insurance. If you’re a solo cleaner, it’s not mandatory, but insurance is a smart move to protect yourself and your business. Learn about cleaning business insurance in Florida.

Even if insurance isn’t required where you are, having it is a no-brainer. It helps protect you from costly accidents and makes you look more professional to potential clients.

What Types of Insurance Do Self-Employed Cleaners Need?

Here’s a breakdown of the key types of self-employed cleaner insurance you need to keep your business running smoothly and safely.

If you clean at clients’ homes or businesses

You need general liability insurance.

Every business needs to carry general liability insurance. This is your go-to for accidents like damaging a client’s furniture or if someone trips over your equipment. It’s essential for protecting yourself against unexpected claims cleaning businesses face and keeping your business secure.

It’s also essential for landing work, especially with commercial clients. Most will require you to show proof of general liability coverage and may ask to be added to your policy as an additional insured (more on that below!)

If you store customer data or accept payments online

You need cyber liability insurance.

If you store customer data or process payments online, this is a must-have. It protects you in the event of a data breach or cyberattack, keeping you safe if sensitive information gets compromised.

If clients, landlords, or business partners require proof of coverage

You need a Certificate of Insurance (COI) and the ability to add additional insureds.

Sometimes, clients or business partners will ask for a copy of your COI or Acord, which is your general liability policy. They may even ask to be added to your insurance policy. Being an additional insured on your policy gives them extra protection if anything goes wrong during your work.

If you use expensive cleaning tools and equipment

You need tools and equipment coverage.

Cleaning supplies and equipment can be pricey, and accidents happen. This coverage, also known as inland marine insurance, ensures your tools are protected against theft, damage, or loss, so you’re not left paying out of pocket for repairs or replacements.

If you want to reassure your clients about theft during cleaning jobs

You need a janitorial bond.

A janitorial bond protects your clients in case something goes wrong, like if there’s theft caused by you or an employee during the cleaning process. This coverage helps build trust with clients and ensures they feel secure hiring you.

Check out our guide to cleaning business insurance and bonding to learn more.

If you have employees working for you

You need workers compensation insurance.

Workers compensation coverage is essential if you have employees. It covers medical expenses and lost wages if an employee is injured while working. This policy is not just a good idea — it’s often legally required depending on your location.

If you drive a vehicle for your cleaning business

You need commercial auto insurance.

If you use your vehicle to transport cleaning supplies or travel to client sites, commercial auto insurance is a must. Personal car insurance won’t cover you for business-related driving, so this type of coverage ensures you’re protected in case of an accident while on the job.

How Much Does Insurance for Self-Employed Cleaners Cost?

The cost of cleaning business insurance for your business depends on the coverage you choose. Cleaning insurance through Insurance Canopy starts as low as $39 per month or $435 per year — much lower than the national average of $520. That’s a significant savings, which is why so many cleaning businesses choose us!

Compare what our customers pay on average to the industry average for the types of coverage your business needs.

| Type | Our Average Price Per Year | Industry Average Per Year | General liability | $679.92 | $884.81 |

|---|---|---|

| Tools and equipment | $51.64 | $384.41 |

| Janitorial bonds | $131 | $126 |

| Additional insureds | $10 | $10 |

| Workers compensation | $1,141.86 | $1,627 |

| Cyber liability | $99 | $1,740 |

These prices are based on the median cost of policies purchased through Insurance Canopy.

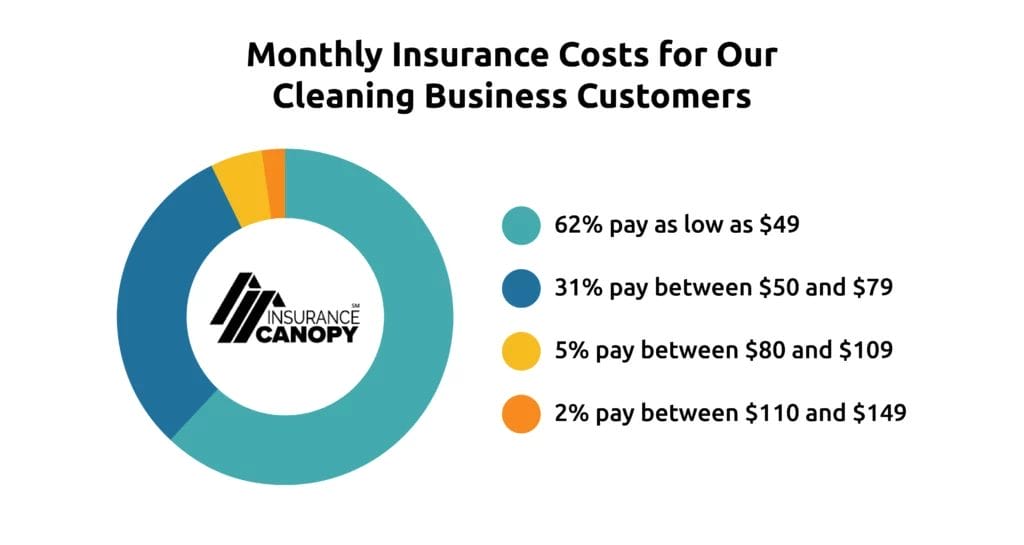

Monthly Costs for Our Cleaning Business Customers

With affordable options like these, you get the coverage you need at a cost that fits your budget. Plus, we make it simple — just choose the policies that best fit your business, and you’re good to go.

How to Get Self-Employed Cleaner Insurance

Applying for cleaning insurance with Insurance Canopy is super easy, and we’re here to make the process smooth for you. You can complete the entire process online in a matter of minutes!

But if you do want help or have questions, you’re also welcome to contact our customer service team. They are licensed, non-commissioned agents who can answer your questions and help you get the best coverage for your business, and help from a real person is available in both English and Spanish from 8 AM – 8 PM Eastern, Monday – Friday.

Here’s how to get started:

- Fill out our simple online form

Just give us a few details about your cleaning business — don’t worry, it’s quick and painless! - Pick the coverage you need

Based on your info, we’ll help you choose the right insurance options. Whether you need general liability, equipment insurance, or workers comp, we’ve got you covered. - Get your quote

After selecting your coverage, you’ll see an affordable quote. We believe in keeping prices fair while giving your business the protection it deserves. - Complete your application

Once you’re happy with your quote, just finish up the application. It’s fast and secure! - Start your coverage

Once your application is approved, we’ll send you all the details, and your insurance kicks in right away. Simple as that!

Ready to get started? Fill out the form and protect your cleaning business in minutes!

Tip: If you’re weighing your options, we have a breakdown of the best cleaning business insurance and bond providers.

Questions About Cleaning Insurance for Self-Employed Cleaners

Do I need insurance if I work for a cleaning company?

If you’re working as an employee for a cleaning company, the company’s insurance should cover you for most situations. However, if you’re working as an independent contractor or freelance cleaner, you will need your own self-employed cleaner insurance for protection.

Is cleaning insurance tax-deductible?

Yes, cleaning insurance is typically tax-deductible as a business expense. Be sure to consult a tax professional to confirm what applies to your specific situation.

Do I need insurance if I only clean homes part-time or occasionally?

Yes — even if you only clean homes part-time or occasionally, you need cleaning insurance. Accidents can happen at any time, and having coverage ensures you’re protected from potential claims, regardless of how often you clean.

Is cleaning insurance different for residential vs commercial cleaners?

Yes, there are some differences. Commercial cleaning often involves larger spaces and equipment, which might require more coverage. The good news? The cost of cleaning insurance typically stays the same whether you’re cleaning homes or businesses. Costs only increase if you have more employees and need to add workers’ compensation insurance.

Protect Your Cleaning Business Today!

Cleaning insurance for self-employed professionals gives you peace of mind, knowing you’re covered in case something goes wrong. It’s an affordable way to protect your business, your clients, and your hard-earned reputation.

Ready to take the next step? Don’t wait until it’s too late, get your cleaning business insurance today and start cleaning with confidence!