The best protection for your business starts with understanding your landscaping insurance coverage. This quick guide cuts through the jargon and equips you to manage your coverage, avoid mistakes, and prepare for anything that comes your way.

Must-Know Landscape Insurance Coverage Terms

Insurance terms can feel like another language, but knowing these key terms helps you make informed decisions about your coverage.

Want to learn more? Visit our insurance glossary for more details.

What’s Covered in Your Landscaping Business Insurance

You can’t predict every bump in the road, but you can manage the aftermath with the right coverage. Here’s what your landscaping insurance covers to confidently handle any surprise.

General Liability Insurance

General liability insurance protects you from third-party claims, such as bodily injuries, property damage, and legal costs. It covers accidents related to your business, helping you avoid financial losses from lawsuits or medical expenses.

It covers:

- Bodily injury

- Property damage

- Legal fees

- Medical payments

Example: A landscaper in Florida was using a weed whacker near a client’s driveway when a rock was accidentally kicked up and cracked the homeowner’s car windshield. The homeowner filed a $3,500 property damage claim. General liability insurance covered the cost of the repairs and legal fees associated with the incident.

Add-Ons

Depending on the size and nature of your landscaping business, you may need additional coverage. Insurance Canopy offers several ways to expand your protection and customize your policy to fit your needs.

Trailer and Equipment Insurance

Covers the cost of repairing or replacing stolen or damaged landscaping tools and machinery.

Example: Someone broke into a landscaper’s trailer overnight and stole $8,000 worth of mowers and trimmers. Trailer and equipment insurance covered the cost of replacement.

Tip: Pairing this with general liability gives you broader protection, since each covers different risks.

Workers Compensation Insurance

Provides coverage for employee injuries if they’re hurt on the job — including medical bills and lost wages.

Example: A crew member suffered a back injury while lifting heavy sod rolls. Workers comp covered their medical treatment and partially lost wages.

Commercial Auto Insurance

Protects company-owned vehicles used for business purposes in case of accidents, theft, or vandalism.

Example: A landscaping truck was rear-ended by an uninsured driver while transporting mulch, causing $5,000 in repairs. Commercial auto insurance covered the damages.

Cyber Liability Insurance

Covers financial losses due to cybercrime, such as data breaches or hacking incidents affecting your business.

Example: A hacker accessed a landscaper’s client database, leading to fraudulent charges on customer accounts. Cyber liability insurance helped cover legal costs and notification expenses.

Landscaping Bonds

Landscapers commonly use three types of bonds to meet legal requirements and build trust with clients.

License and Permit Bond

State and local governments require this bond to ensure landscapers follow regulations and operate legally.

Example: A landscaping business needed a license and permit bond to obtain a local business license. Without it, they couldn’t legally offer services in their area.

Contractor Bond

Large-scale and government projects require this bond to guarantee that landscapers complete the work as agreed.

Example: A landscaper won a contract to install irrigation systems for a city park. The contractor bond ensured the city would receive compensation if the landscaper failed to complete the project.

Business Service Bond

Offers financial protection if an employee commits theft while working at a client’s property.

Example: A client accused a landscaper’s employee of stealing an expensive power tool from their garage. The business service bond ensured the client was reimbursed, but the business owner was responsible for repaying the bond company for the claim.

What’s Not Covered in Your Landscaping Business Insurance

Not everything falls under your policy. These services and risks require separate coverage or aren’t covered at all:

- Design or architecture

- Handling infectious waste or hazardous materials

- Irrigation or sprinkler installation (only incidental damage repair allowed)

- Swimming pool, water feature, or pond installation/maintenance

- Retaining walls, land preservation, or erosion control

- Hardscaping

- Window washing

- Exterior work over two stories

- Use or application of any pesticide or herbicide requiring a license

- Stump grinding or removal

- Inspection, appraisal, or surveying

- Planning or designing land development (e.g., parks, recreational areas, airports, highways, hospitals, schools, land subdivisions, and commercial, industrial, or residential areas)

Coverage Limits for Landscaping Business Insurance

From on-the-job accidents to property damage, each policy limits how much it will pay for different claims. Knowing these limits helps you prepare for the unexpected and ensures you’re not caught off guard.

Maximum Landscaping Liability Insurance Limits

The most your policy will pay in a 12-month policy period for bodily injury and property damage claims that you become legally obligated to pay due to your business services.

$2,000,000

The maximum amount your policy will pay in a 12-month period for bodily injury and property damage claims that result from the products you use to perform your services. However, it does not cover products that are sold, or distributed.

$2,000,000

The maximum your policy will pay for a bodily injury or property damage claim that you become legally obligated to pay due to your business services.

$1,000,000

The amount that your policy will pay for claims arising out of one or more of the following offenses:

- False arrest, detention or imprisonment

- Malicious prosecution

- Wrongful eviction or wrongful entry

- Oral or written publications that slander or libels a person or organization

- Oral or written publication or material that violates a person’s right of privacy

- The use of another’s advertising idea in your advertisement

$1,000,000

Applies to damage by fire to premises rented to the insured and to damage regardless of cause to premises (including contents) occupied by the insured for 7 days or less.

$100,000

A general liability coverage that reimburses others, without regard to the insured’s liability, for medical or funeral expenses incurred by such persons as a result of bodily injury or death sustained by accident under the conditions specified in the policy.

$5,000

Optional Coverage Options

Tools & Equipment Coverage

Limits

Premium

Deductible

$5,000 Policy Year

$155

$500

$10,000 Policy Year

$258

$25,000 Policy Year

$670

Coverage Limit Definitions

Not quite sure what all these limits mean? Don’t worry, we’ve got you!

General Aggregate

This is the most your policy will pay within 12 months for bodily injury and property damage claims that result from your landscaping services. Think of it like the pool of money your policy can pull from within a year.

Limit: $2,000,000

Products and Completed Operations Aggregate

This limit applies to claims arising from bodily injury or property damage caused by the products you use or your completed work.

For example, if a lawn treatment product causes damage to a client’s property, this coverage will kick in. However, it doesn’t cover products sold or distributed outside of the scope of your landscaping services.

Limit: $2,000,000

Each Occurrence Limit

This defines the maximum amount your policy will pay for a single claim of bodily injury or property damage caused by your landscaping services. For example, if a rock from a lawnmower flies through a window and causes property damage, this limit applies.

Limit: $1,000,000

Personal and Advertising Injury Limit

This limit covers claims arising from defamation, wrongful eviction, or false arrest. It can apply if your landscaping business is accused of making slanderous statements or using someone else’s advertisement idea without permission.

Limit: $1,000,000

Damage to Rented Premises Limit

This coverage protects you if damage occurs to your rented premises, including tools or storage spaces. For example, if a fire breaks out while you’re working in a rented property, this limit covers the cost of repairs or replacement.

Limit: $100,000

Medical Expense Limit

This coverage applies to medical or funeral expenses resulting from bodily injury or death sustained by someone on your property, regardless of fault. It’s particularly useful for covering minor accidents, like if a client trips over equipment or gets injured by your landscaping tools.

Limit: $5,000

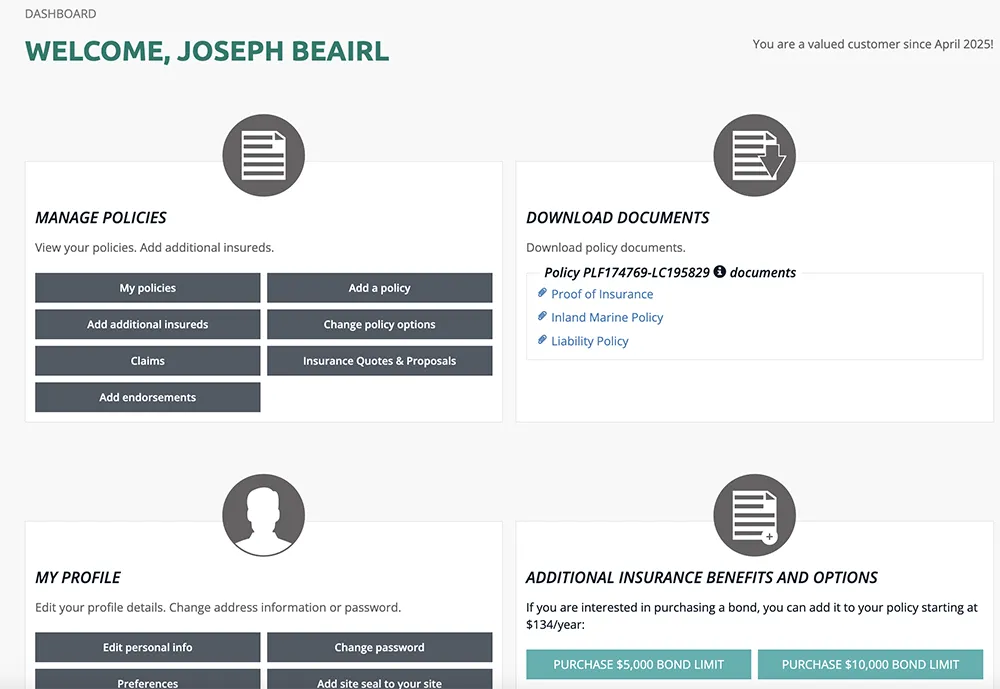

Managing Your Policy With Insurance Canopy

Managing your landscape insurance coverage is quick and easy with Insurance Canopy. Whether you’re reviewing, renewing, or updating your coverage, or you need to file a claim, we make it simple to stay on top of your protection.

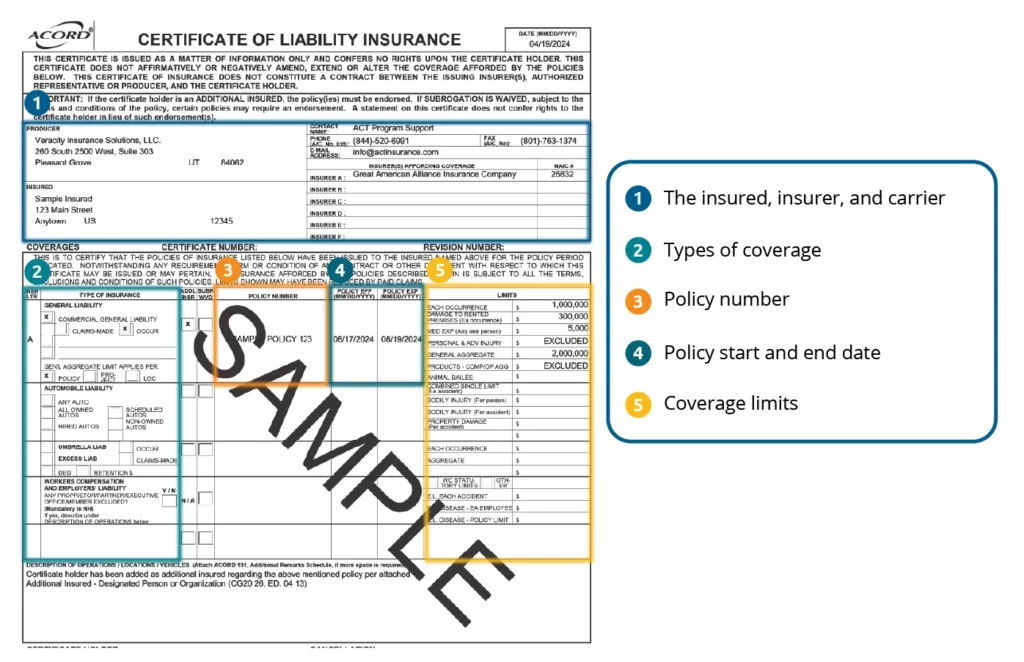

How to Review Your Policy

Access your policy details and Certificate of Insurance (COI) by logging into your customer dashboard. In just a few clicks, you can view all of your essential policy info.

How to Renew Your Policy

If you opt for EZ Renew, renewing your policy is automatic. You don’t have to worry about gaps in coverage! Before your policy expires, we’ll send you an email reminder. If you want to make any changes to your coverage, simply reach out to us — we’re ready to help.

How to Update Your Policy

Updating your policy is as easy as logging into your user dashboard. You can add optional coverage, update your business info, change your limits, and add additional insureds, all online. For more complex updates, our support team is available to assist you.

How to File a Claim

When things don’t go as planned, here’s how you can file a claim with Insurance Canopy:

- Report the incident: If authorities are involved (e.g., for theft or injury), file the report immediately. Document the incident thoroughly — capture the date, time, location, photos, and any injuries.

- Gather your documents: Have your policy details, receipts for damaged or stolen equipment, and a written account of the incident ready.

- Submit your claim online: Log in to your account, go to “Manage Policies,” click “File a Claim,” and fill out the form.

- Follow-up: Once submitted, a claims adjuster will reach out within 24-48 hours. Be ready to provide additional information like photos or receipts.

Questions About Landscaping Insurance Coverage

How do I get proof of insurance for a client or vendor?

You can instantly download your Certificate of Insurance (COI) from your online dashboard. You can also contact our support team if you need special wording or endorsements.

How do I cancel my policy?

You can easily cancel your policy at any time through your online dashboard. Please note that our policies are fully earned once coverage starts, so they’re generally non-refundable. Don’t forget to check your policy details for eligibility for refunds.

Can I dispute a denied claim?

Yes, you have the right to dispute a denied claim. If your claim is denied, get in touch with your claims adjuster to go over the details and discuss your options. We’ll help you understand the reason behind the denial and work with you to figure out the next steps.

Need Help With Your Policy? We're Here for You!

You’ve already secured your landscaping insurance — now let’s make sure you have everything you need. If you have any questions about your coverage or need to make updates, we’re here to help. Contact us for support and guidance on managing your policy.