In Part One of this series, we discussed the policy triggers, the definition of an “occurrence”, and the Occurrence Form policy features and its reporting requirements.

In Part Two, we will be reviewing the Claims-Made Form and its claim, and/or incident, reporting requirements. In addition, we will make some comparisons of the Occurrence Form and Claims-Made Form and the differences in the claims reporting requirements.

As mentioned in Part One, the term “Occurrence” is the same in both ISO Occurrence and Claims-Made policy forms. It is, “an accident, including continuous or repeated exposures to substantially the same general harmful conditions”.

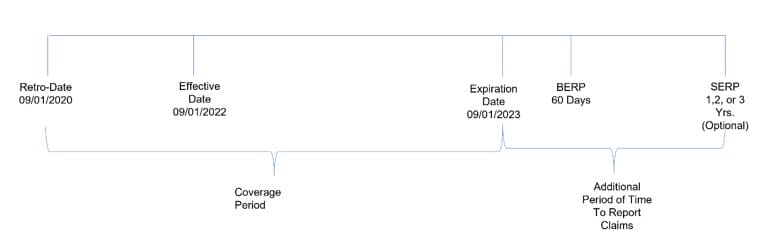

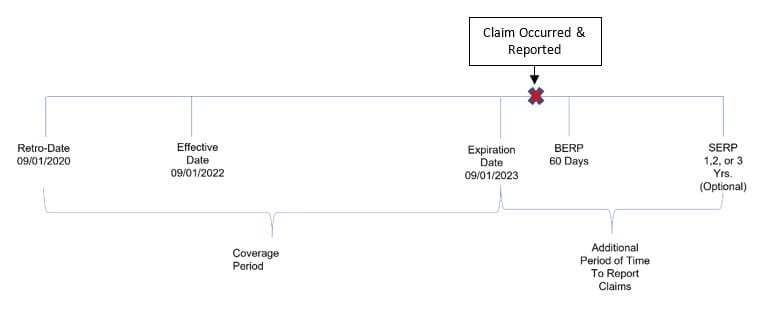

The Claims-Made policy has a few more moving parts than the Occurrence From policy in the coverage period and claims reporting requirements. The below items are critical for you to understand if your product liability insurance is written on a Claims-Made policy form.

These items are:

- Retroactive Date (Retro-Date): A date established defining how far back a loss can occur for your policy to respond. There are times when your retro-date will be the same as your policy effective date. This is called retro-date inception (RDI). Any claims occurring prior to the retro-date would not be covered.

- Policy Effective Date: The period the policy begins.

- Policy Expiration Date: The time the policy ends.

- Basic Extended Reporting Period (BERP): The time period automatically provided by the policy to allow claims to be reported after the policy expires. This is typically 60 days, but some policies may vary of time automatically given.

- Supplemental Extended Reporting Period (SERP): Additional period of time you purchase to report claims that occurred during your policy period after your policy has expired. Your options for a supplemental extended reporting period are usually 1, 2, or 3 years.

If you were to lay out the structure of a claims-made policy, it would look something like this:

There are two things that need to happen for a claims-made policy to respond, to trigger coverage:

- Claim needs to occur during the coverage period

- Claim needs to be reported to the insurance carrier during the coverage period or during the extended reporting period(s)

It is important to understand that the Extended Reporting Periods in a Claims-Made policy is not an additional coverage period. It is only additional time to report claims that occurred while your policy was in force but may not be aware of at the time.

Once the extended reporting period expires, the policy will not accept any additional reported claims that occurred during the policy period. This reporting requirement is much more restrictive than the Occurrence Form policy.

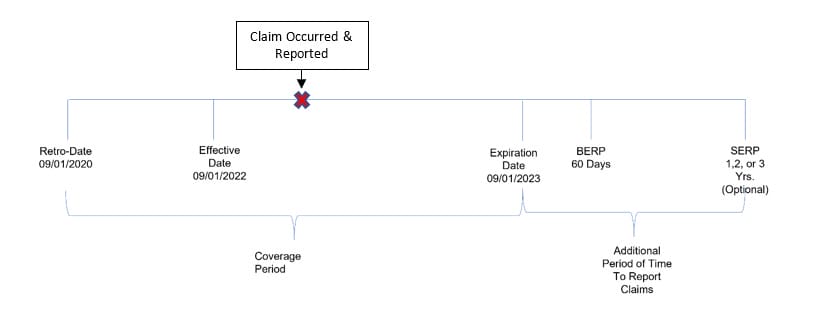

Example 1: If you have a product liability incident occur and reported to the insurance carrier on December 15, 2022, this will fall within the coverage period and be reported during the coverage period or extended reporting period.

This claim/incident would satisfy both two Claims-Made triggers; the claim needs to occur during the policy period and reported to the insurance carrier during the coverage period or during the extended reporting period(s)

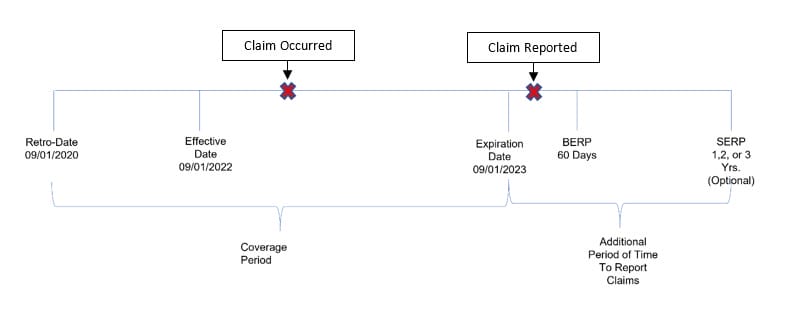

Example 2: You have a product liability incident occur on December 15, 2022, but report to the insurance company on 10/01/2023. The policy would respond to the claim because the claim occurred during the coverage period and was reported during the included basic extended reporting period (BERP). This meets the two requirements of the Claims-Made policy.

Example 3: You have a product liability claim occur on December 15, 2022, but you didn’t find out about the claim, or report the claim, until September 1, 2025. Two years after the policy has expired. Will the policy respond? Maybe.

If in this example the Supplemental Extended Reporting Period (SERP) was purchased, the policy would respond. If it was not purchased the policy would not.

Remember the two triggers that need to occur; 1) Claim/incident must occur during the coverage period – which it did. 2) The claim/incident needs to be reported to the carrier during the coverage period or extended reporting period.

So, if the SERP was not purchased, you are outside the included Basic Extended Reporting period therefore, only one of the two triggers has been satisfied.

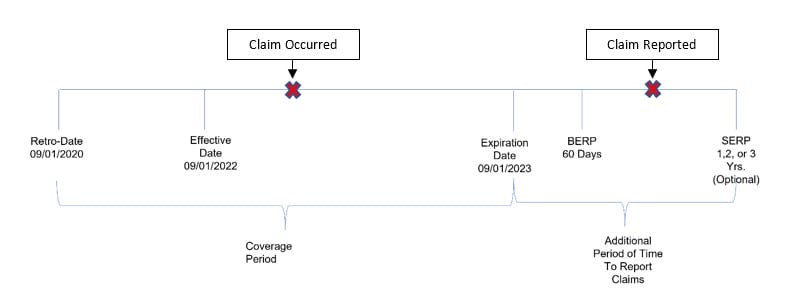

Example 4: Your product liability claim occurred and was reported on 10/01/2023, both during the included Basic Extended Reporting Period. The policy would not respond because the claim did not occur during the coverage period, the claim occurred after the policy expired.

The Extended Reporting Period (ERP)—Basic or Supplemental—does not provide any coverage. If you remember, the purpose of the ERP is to provide additional time to report claims or incidents that occurred during the coverage period that you may not be aware of.

Unlike the Occurrence Form policy, once the extended reporting period has expired in a Claims-Made policy there is no more coverage available through the policy, even if the claim did occur during the coverage period.

Therefore, it is extremely important to understand the type of product liability insurance you carry and how it will respond to claims, and your responsibility to report claims.

Back To The Original Question

Going back to the original question, “How long do I need to keep my product liability insurance?” my response would be the same as in Part One on the Occurrence Form. The answer is, you need to keep your product liability insurance policy in force as long as you have exposure to someone getting injured by your product.

If you are planning on pivoting and contemplating canceling your product liability insurance, you need to consult with your insurance professional to come up with options to maintain insurance coverage for your existing products – your exposure – that is still on the market.

If you have additional questions about the information provided or would like to speak to one of our licensed representatives, please contact us at 844.520.6993.

Disclaimer: All policies have specific coverage, limitations, exclusions, and conditions. Please refer to your policy for exact coverages. Also, time limitations of claims may be subject to specific state statutes of limitations and statutes of repose.