A Certificate of Insurance is a document that details and validates a vendor’s insurance coverage. It’s also known as an ACORD or proof of insurance.

You may need a Certificate of Insurance if you plan on being a vendor at events or markets, or are hired for special occasions. It helps you meet certain contract requirements and boosts your credibility as a professional, making it easier to secure your spot at prime events!

What is a Certificate of Insurance (COI) for a Vendor?

A vendor COI is an official document that verifies key information about your vendor insurance. It mainly lets you show an event organizer or venue you have the necessary coverage to pay for potential accidents your business may cause.

These certificates are like ID cards for insurance — it has names, contact info, an expiration date, and an identification number.

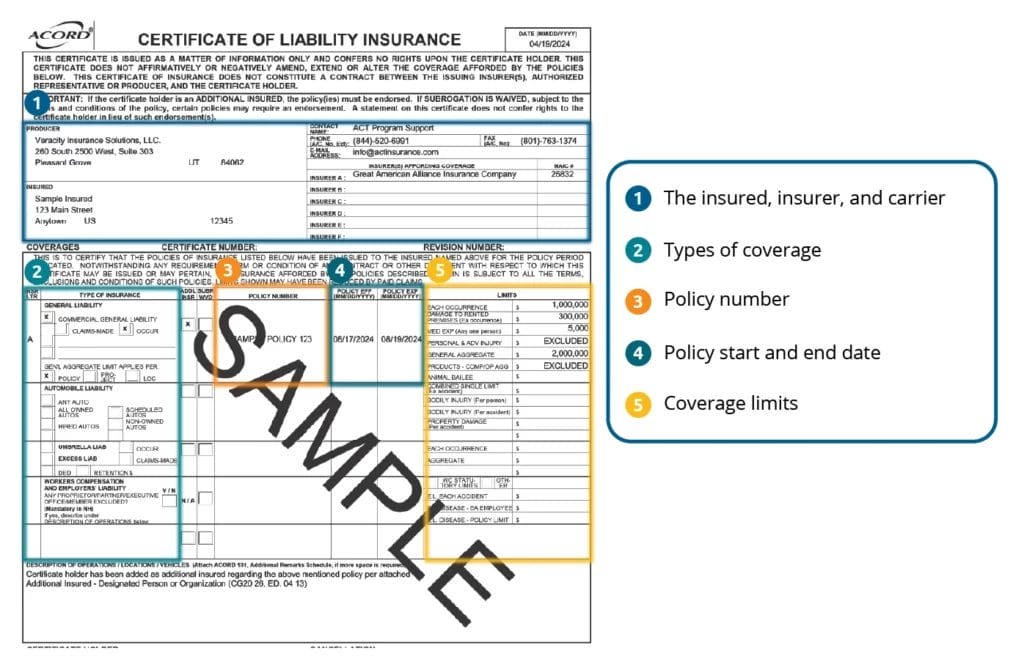

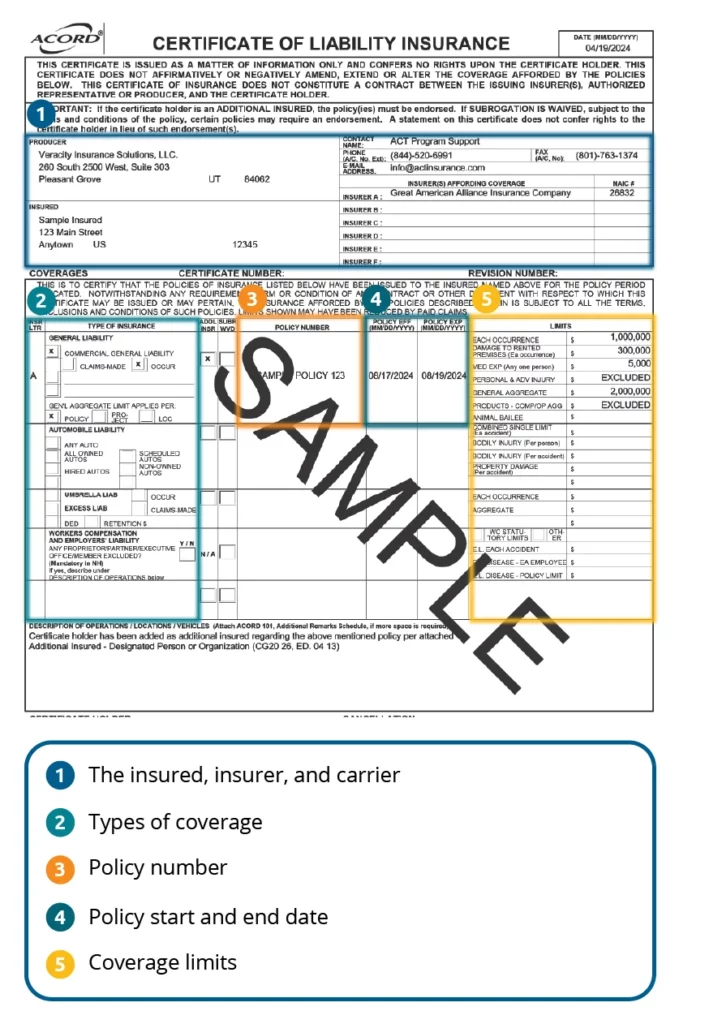

Your certificate contains key information about your insurance coverage, including:

- The insured, insurer, and carrier: Name and contact information for you (the insured), the company you bought the policy from (the insurer), and the company that issues the coverage and handles claims (the carrier).

- Types of coverage: A list of the specific coverage you have on your policy. This can also include additional coverage you add to your policy.

- Policy number: The unique identifier for your policy that helps the insurer and carrier access your coverage details in the instance of a claim.

- Policy start and end date: The day your coverage begins (effective date) and ends (expiration date). This is known as the “policy period,” and is the point in time when your coverage is in effect.

- Coverage limits: The maximum amount of coverage your policy can provide. Aggregate is the total amount per policy and Per Occurrence is the total amount per claim.

When you buy vendor insurance from Insurance Canopy, we instantly provide you with a copy of your vendor COI. This makes it easy to show proof of insurance quickly.

Proof of Vendor Insurance Instantly

Get an instant Certificate of Insurance when you buy a policy online today.

How to Obtain a Certificate of Insurance

To obtain a Certificate of Insurance, you must first purchase a vendor insurance policy. From there it’s easy to access and download copies from your online dashboard to use as proof of insurance whenever you need!

Purchase a Policy From an Insurance Provider

Insurance Canopy specializes in providing tailored insurance for vendors. With our simple online process, you can purchase a policy in just 10 minutes or less.

- Pick and personalize your policy

- Complete the online application

- Submit payment online

- Get instant access to your COI

- Add additional insureds from your dashboard 24/7

Information Needed for Issuance

You will only be issued a COI after you purchase a policy. To buy coverage, you will need to:

- Select your policy type and start date

- Provide your contact information

- Provide your business’s information

- Agree to the terms and conditions

- Provide a valid form of payment

You can update your policy information and additional insured information at any time from your online dashboard. You can also instantly access an updated COI at any time.

Access Your Certificate

With Insurance Canopy, you don’t have to wait to receive your COI or pay for multiple copies. You can download an unlimited number of certificates for free:

- Log in to your online dashboard

- Locate “Download Documents”

- Click on “Proof of Insurance”

A copy of your certificate will automatically download to your device.

It’s best to access your COI as soon as possible so you can ensure it’s correct and keep a copy for your business records. This also makes it easy to share a copy whenever you need to show proof of insurance.

Your certificate is valid throughout the policy period, which is the time between the effective and expiration dates. If your policy is canceled, the COI will no longer serve as valid proof of insurance.

Why Vendors Need a Certificate of Insurance

Vendors typically need a Certificate of Insurance to be accepted into events and fulfill contractual obligations. It shows you have taken steps to protect your business and are responsible for managing its risks.

- Contractual requirements: COIs are often required by event organizers, landlords, and clients to show you could cover incidents that occur during their event or on their property.

- Risk mitigation: A COI is tangible proof you have the financial support to pay for a claim, significantly reducing the risk of out-of-pocket expenses you might otherwise owe.

- Professional credibility: Having a COI showcases your commitment to your business. It lets others know you’re responsible, trustworthy, and reliable, even if an accident occurs.

“Starting and growing your business is a significant investment, and having insurance as a vendor is a straightforward way to protect that investment, along with your business finances and personal assets. By absorbing these financial impacts, insurance allows your business to operate smoothly and provides you with peace of mind.”

—JoAnne Hammer, Insurance Canopy Program Manager, CIC. Certified Insurance Counselor since 2004

Types of Insurance Coverage Listed on COIs

Standard short-term vendor insurance policies include General Liability, Damage to Rented Premises, and Medical Expense Limit coverages. This helps cover the most common claims you’ll likely face as a vendor, such as slips and falls or accidental property damage.

- General Liability Insurance: Covers you for injuries or damages caused by your business operations, mainly slip and fall accidents or unexpected weather.

- Damage to Rented Premises: Covers you for damages caused in rented spaces during an event or set-up/take-down. It covers a variety of risks for the first 7 days and provides fire liability coverage thereafter.

- Medical Expense Limit: This no-fault coverage lets you pay for medical treatment for a person injured in an accident caused by your business.

Some vendors need additional coverage due to the type of work they do, the event they are attending, or the requirements they need to fulfill.

Depending on the policy you pick, most specialty or annual vendor policies offer coverage for product injuries, liquor liability, or stolen equipment.

- Professional Liability Insurance: Also known as Errors and Omissions (E&O), this covers injuries or damages caused by paid professional services, advice, teaching, mentoring, and demonstrations.

- Product Liability Insurance: Also known as Products & Completed Operations, this covers injuries or damages caused by products you make, sell, or use in a service, or accidents that occur after a service.

- Personal & Advertising Injury: This covers you for legal fees if you accidentally violate copyright, infringe on intellectual property, or are accused of libel or slander.

- Equipment and Inventory Insurance: Also known as Inland Marine, this insures your business items (like tools, supplies, equipment, gear, and inventory) against theft and damages.

- Liquor Liability Insurance: This covers vendors who make, distribute, sell, serve, or provide alcohol for accidents caused by their business or an intoxicated customer.

- Cyber Liability Insurance: Covers damages caused by cyber-attacks on your business, like helping you and your customers recover from stolen funds or data breaches.

COIs and AIs

Third parties typically request a COI to ensure a vendor has adequate insurance coverage before entering into a contract or allowing them to participate in an event. These third parties are known as vendor Additional Insureds (AIs).

An additional insured is a person, place, business, or entity added to a policy to extend coverage in case of a claim. This could include an event, venue, planner, or city.

Get Your Vendor COI Today!

Purchase a policy online and receive your Certificate of Insurance instantly.

Vendor Certificate of Insurance FAQs

Which Vendors Need a Certificate of Insurance?

The most common types of vendors who need a certificate of insurance include:

- Beauty services

- Booths, stalls, and kiosks

- CBD event vendors

- Concessionaires

- DJs and entertainers

- Exhibitors and artists

- Festival, fair, and trade show vendors

- Fitness and wellness services

- Food and beverage vendors

- Liquor services

- Photographers and videographers

- Special event vendors

If you are occupying a space at a festival, renting a booth, or working a special event, you are likely a vendor who needs insurance.

How Do I Generate a Vendor Certificate of Insurance?

You generate a vendor Certificate of Insurance by:

- Logging in to your online account

- Clicking on “Proof of Insurance” under “Download Documents”

- A PDF of your certificate will automatically download

With Insurance Canopy, you can generate as many copies of your COI as needed!

What Does a Vendor Certificate of Insurance Include?

A vendor certificate of insurance includes a policyholder’s name, policy number, types of coverage, coverage limits, and effective dates.

It can also include information about any named additional insureds.