Fitness Instructor Insurance Cost

We get it: complicated insurance costs make you want to throw in the towel. But you deserve to understand and decide where your business’ money goes.

Learn how much our fitness instructor policyholders pay, what your policy gets you, and all the variables in your fitness instructor insurance cost.

JoAnne Hammer is the Program Manager for Insurance Canopy. She has held the prestigious Certified Insurance Counselor (CIC) designation since July 2004.

JoAnne understands that starting and operating a business takes a tremendous amount of time, dedication, and financial resources. She believes that insurance is the single best way to protect your investment, business, and personal assets.

JoAnne Hammer | Program Manager

JoAnne Hammer is the Program Manager for Insurance Canopy. She has held the prestigious Certified Insurance Counselor (CIC) designation since July 2004.

JoAnne understands that starting and operating a business takes a tremendous amount of time, dedication, and financial resources. She believes that insurance is the single best way to protect your investment, business, and personal assets.

How Much Does Fitness Instructor Insurance Cost?

Fitness instructor insurance costs as little as $15 per month or $159 per year with Insurance Canopy.

Our $15/month base policy covers the common claims fitness instructors face, but you can also customize your policy by adding extra protection for what makes your business stand out.

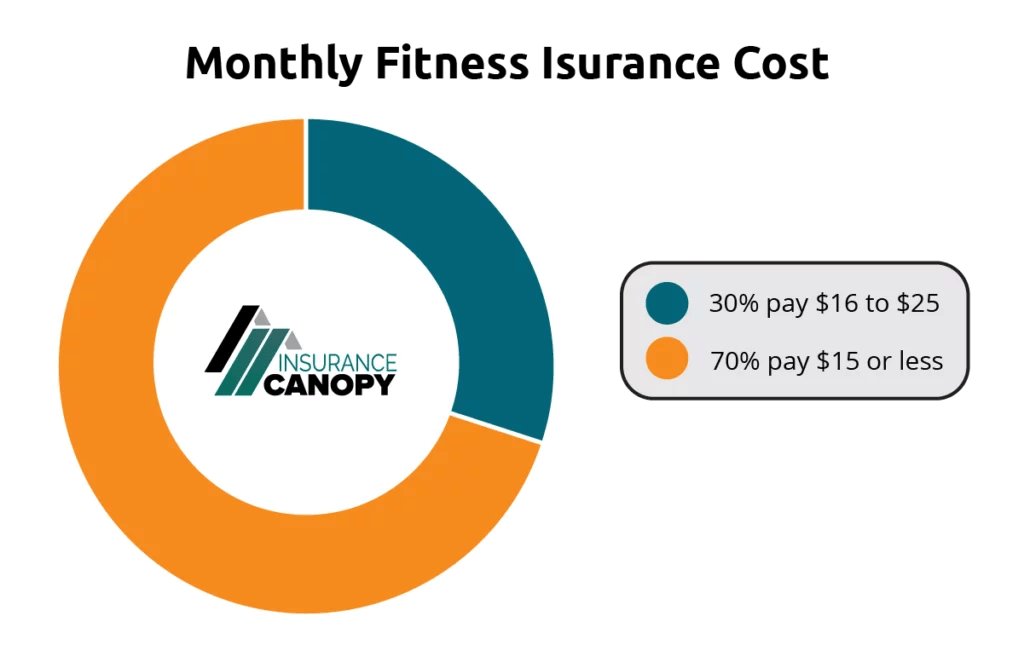

Here is the breakdown of the fitness instructor liability insurance cost our policyholders pay:

Note: based on Insurance Canopy fitness instructor data from July 2024

What’s Included for $15/Month or Less?

$15/month or $159/year gets you all the essential coverages:

- General Liability

- Professional Liability

- Products-Completed Operations

- Personal & Advertising Injury

- Damage to Premises Rented to You

- Medical Expense Limit

The vast majority of our policyholders (70%) buy only the base fitness instructor insurance for $15/month or less. Of that group, 68% chose our discounted annual payment plan, which brings your fitness insurance costs down to $13.25/month. 32% of our fitness customers paid the full base price of $15/month.

What’s Included for $16/Month to $25/Month?

You can opt into these extra coverages for your fitness business:

- Gear and Equipment (Inland Marine) Coverage (our most popular add-on for trainers!)

- Additional Insureds

- Diet or Nutrition Coverage

- Cyber Liability (Data Theft) Coverage

- Sexual Abuse & Molestation (SAM) Coverage

30% of our policyholders personalize their fitness trainer insurance cost with one or more of these optional coverages. Coverage prices vary, so depending on which you choose and how many you add, your monthly premium goes up accordingly.

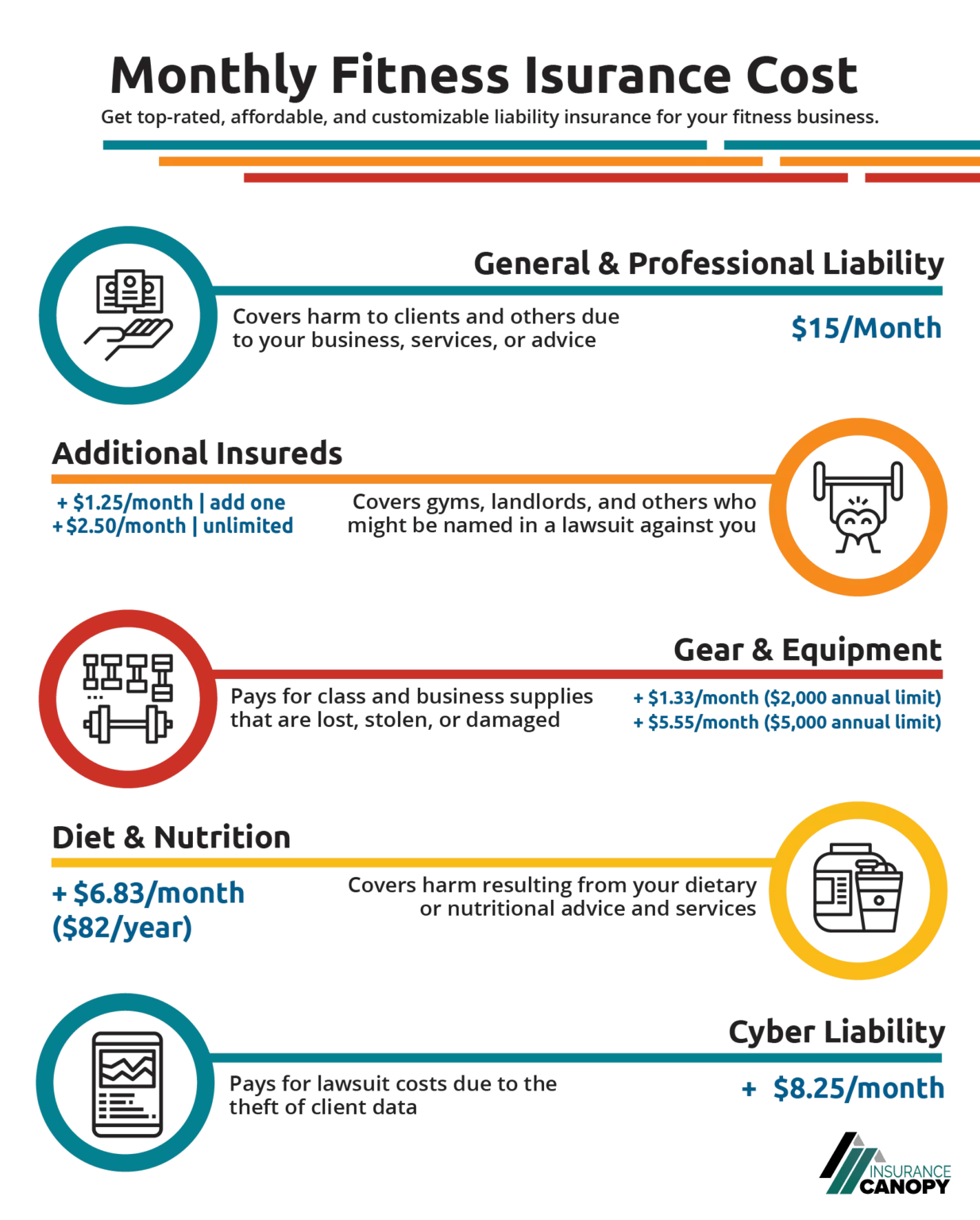

How Much Does Each Fitness Business Insurance Coverage Cost?

What Factors Affect Fitness Insurance Cost?

The coverages you add and the payment plan you choose can impact your fitness business insurance cost.

Insurance Canopy offers a $15/month payment for fitness instructor policies. Some insurance companies determine prices for individuals using a complex formula based on business size, type, income, history, and risks, for example.

Only the coverages and the monthly or annual payment option you select will change your price, so you control how much you pay.

If you qualify for coverage, you’re covered at the same low rate for any type of fitness class, class size, and location, regardless of your experience level.

These are the requirements to qualify for our fitness instructor insurance:

- Your fitness classes do not fall under any of our three excluded classes:

- Martial arts (like MMA and judo)

- Aerial sports (like aerial yoga and pole dance)

- Water fitness (like swim coaching and water aerobics)

- Operations or services involving an equine

- You live within the U.S. (we’re available for business in all 50 states, but we don’t sell policies in Missouri)

- You do not have any prior claims

- You have earned any certifications or licenses required by your local government

Can I Reduce the Cost of My Insurance?

Insurance Canopy offers the lowest rates possible for quality, comprehensive coverage. But we still like giving you ways to save.

You get to choose between a $159 annual payment and a flexible $15 monthly rate. If you teach year-round, you save about 13% with an annual plan rather than monthly installments. That’s why 68% of our fitness policyholders choose to grab their discount by paying once a year.

Another way to limit business costs is to reduce your risk of fitness instructor lawsuits. You can’t avoid every training mishap or overstretched muscle, but you can keep the chances low with awareness and planning. Try these risk management tips:

- Prevent common fitness injuries by conducting regular client health assessments

- Check your space for tripping hazards like discarded equipment, spills, and uneven terrain

- Keep exercise equipment on an inspection and maintenance schedule

- Ask students to sign a fitness liability waiver for an extra layer of risk awareness and legal protection

- Stay current on certifications and continuing education for the latest research and safer methods

Why Insurance Canopy for Low-Cost Fitness Instructor Insurance?

- Industry-preferred General and Professional Liability coverage

- Customizable policy

- Monthly and yearly payment options

- Coverage for 100+ teaching styles

- 24/7 online access

- Instant certification of insurance

Coverage Details

General & Professional Liability Limits

$3,000,000

$3,000,000

The amount your policy will pay for claims arising out of one or more of the following offenses:

– False Arrest, detention or imprisonment

– Malicious prosecution

– Wrongful Eviction or Wrongful Entry

– Oral or written publications that slander or libels a person or organization

– Oral or written publication or material that violates a person’s right of privacy

– The use of another’s advertising idea in your advertisement

Included

The maximum the insurance carrier will pay for a bodily injury or property damage claim that you become legally obligated to pay due to your business and professional services.

$2,000,000

Applies to damage by fire to premises rented to the insured and to damage regardless of cause to premises (including contents) occupied by the insured for 7 days or less.

$300,000

$5,000

The amount we deduct from a claim before paying up to your policy limits.

$0

Optional Add-Ons

Price

$1.33–$5.55/month

The maximum amount paid out in the case of a cyber attack on your business. Because this coverage is not automatically included in the standard General Liability Policy, you will need to opt into this coverage. See the application for additional coverage details for Cyber Liability Insurance.

$8.25/month

$6.83/month

Coverage for a third party, such as a business, property owner, event organizer, or employer who could be named in a claim arising from your business operations. It cannot be used for employees, friends or family, other trainers, yourself, or other businesses you may own. Add one additional insured for $15, or choose unlimited additional insureds for $30.

$15–$30/year

Coverage for defense costs if you’re wrongly accused of sexual harassment or improper conduct.

$10.33/month

How Do I Get a Fitness Trainer Insurance Quote?

It’s an easy lift! Just follow these steps to get powerfully crafted coverage in 10 minutes or less:

- View your instant quote

- Customize your policy

- Answer some questions about your business

- Pay for your policy and get your instant certificate of insurance

FAQs About Liability Insurance Cost for Fitness Instructors

Does the Type of Fitness Instruction Affect Insurance Costs?

Insurance Canopy charges the same flat rate for fitness instructors, from personal trainers to dance teachers.

Other insurance companies may charge more for higher risk classes (for example, CrossFit has more high-impact activities than yoga). With our flat pricing model, you don’t have to worry about extra costs!

Diet and nutrition services are our only exceptions. If you plan to consult with clients on their dietary habits, meal plans, or supplements, you need specialized coverage. You can add this optional endorsement to your policy for a total fitness instructor insurance cost of $21.83/month.

How Much Does Fitness Insurance Cost Typically?

Insurance Canopy offers fitness instructor insurance for as low as $15/month or $159/year, but you’ll see a variety of rates at other companies. Among our competitors, fitness instructor liability insurance costs $179 to over $500/year. That’s savings from 11% to 68%!

Some insurers factor things like your income, number of students, or teaching locations into your cost, which can raise their prices.

Do You Need Liability Insurance as an Online Personal Trainer?

Even if you never meet your online clients in person, you still need liability insurance for protection from lawsuits due to your business.

Our fitness instructor insurance policy includes professional liability to cover you if your advice leads to mistakes, injuries, or dissatisfied clients. It also offers general liability to protect you against lawsuits due to online advertising mistakes.