Life Coach Insurance Cost

Want to protect your business but wondering if the cost of life coach insurance is worth it? Remove roadblocks on your path to protection with this simple breakdown of liability insurance pricing, and how to keep coverage affordable with Insurance Canopy.

How Much Does Life Coach Insurance Cost?

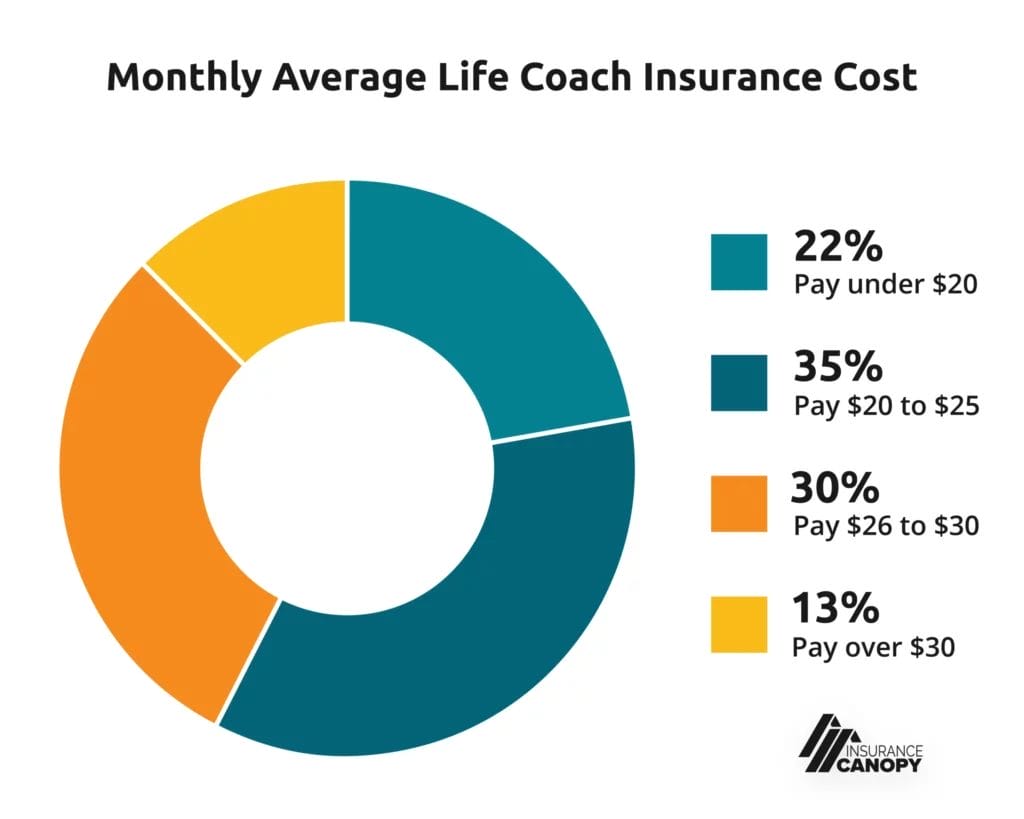

Most of our customers pay between $20 and $25 per month. For a detailed breakdown of how those costs stack up against competitors, see our cost comparison chart.

Life coach insurance costs as little as $21.08/month or $229/year with Insurance Canopy. This base policy covers the necessary coverage for every life coach, but factors like adding protections, your payment plan, and your business details can affect your price. (Don’t worry, we’ll walk through it.)

Our base policy includes these essential insurance coverages to keep you financially protected from the specific risks of life coaching:

- General Liability

- Professional Liability (aka Errors and Omissions)

- Products-Completed Operations

- Damage to Premises Rented to You

- Personal and Advertising Injury

- Free and Unlimited Additional Insureds

Our base policy covers just the protections every life coach needs — no extra charges for coverages you won’t use. Not every coaching business needs expensive supplies like a business computer or stores clients’ personal info, but some do. If that’s you, we offer these optional add-ons to keep your extra risks covered:

- Equipment and Materials (Inland Marine Coverage) for $2.17 a month

- Cyber Liability (Data Theft Coverage) for $8.25 or $12.50 a month — our most popular add-on!

- Sexual Abuse and Molestation (SAM) Liability for $10.34+ a month

Note: This data is based on customer payments for both monthly and annual payment plans.

What Payment Plans Are Available?

Insurance Canopy offers flexible monthly or annual payments to fit your preferences and budget:

- Monthly payments offer lower prices now. Like breaking a big life choice into smaller steps, choosing monthly installments makes paying for insurance more manageable. There is a recurring $2 fee for month-to-month payments.

- Annual payments save money over time. Paying all at once with an annual plan saves you about 10% yearly. That’s roughly $24 in savings you could use for a new online session headset, your coaching app subscription, or a month of LinkedIn Learning courses.

How Much Does Each Type of Coverage Cost?

General Liability: $21.08 a Month or $229 a Year (Higher Limits Available)

This multi-purpose coverage protects you from paying out-of-pocket for bodily injuries and property damage to third parties (like a client or landlord) caused by your business. Professional liability specifically protects your advice if someone claims you made a mistake or were negligent — an important risk for life coaches.

Other coverages included with general liability include products-completed operations, damage to premises rented to you, and personal and advertising injury.

Your life coach insurance policy comes with $1 million per occurrence and $2 million per year of general and professional liability coverage. But what if you have a large or growing practice and need more protection? We also offer the option for a higher $3 million aggregate limit starting at $33.58/month or $378/year.

Equipment and Materials: $2.17/Month

Opting into this coverage can pay for damaged or stolen equipment. Say you work out of your home. If you experience a break-in, homeowners’ insurance usually won’t cover any business equipment you lose — including a work laptop, tablet, or phone. Equipment and Materials coverage could foot the bill for a replacement.

Cyber Liability: $8.25/Month or $12.50/Month

If you store client data, like credit card info, phone numbers, and other personal details, you’re often legally responsible for its safety against data theft and other cyber attacks. Cyber liability insurance safeguards you against legal fees if you need to defend yourself in a data breach lawsuit or help clients pay to recover their info.

Choose from $100,000 in coverage for $8.25/month or $250,000 in coverage for $12.50/month.

More than one in three life coaches add cyber liability to their Insurance Canopy policy!

Additional Insureds: FREE

An additional insured is a person or company added to your insurance coverage because they might be named in a lawsuit against you. For example, a facility manager or landlord may ask to be added to your policy. You can add unlimited additional insureds at no extra cost.

Sexual Abuse and Molestation Liability: Starting at $10.34/Month or $124/Year

Coaching is about the balance between professionalism and genuine care — one that can easily be misunderstood. Protect yourself against wrongful accusations of sexual misconduct with SAM liability insurance. This coverage helps pay for your legal defense after a false allegation, including attorney fees, settlements, and other costs.

Rates start at $10.34/month for coaches with $50,000 or less in gross annual coaching income and max out at $37.83/month for larger corporations with over $250,001 in gross annual sales. We customize your coverage limits based on your business, so you only pay for what you need.

What Factors Affect Life Coach Insurance Cost?

Gross Annual Income

Higher yearly income means you need higher insurance limits to protect your finances. This can increase the cost of your insurance.

Optional Coverages

Personalizing your policy with higher general liability limits or coverage for your equipment and cyber risks adds to your insurance cost.

Claims History

If you filed insurance claims in the past, your insurance costs may go up.

Here’s a breakdown of how your gross annual income affects your insurance costs:

Life Coach Insurance Cost by Income

| Gross Annual Income | General Liability Premium | ||

|---|---|---|---|

|

Individual Life Coach |

|||

|

$0 – $50,000 |

$27.71

|

||

|

$50,001 – $100,000

|

$32.71

|

||

|

$100,001 – $150,000

|

$37.71

|

||

|

Coaching Small Business Owner |

|||

|

$0 – $50,000

|

$33.96

|

||

|

$50,001 – $100,000

|

$40.21

|

||

|

$100,001 – $150,000

|

$46.46

|

||

Can I Reduce the Cost of My Insurance?

An annual plan is a simple way to minimize your yearly life coach insurance cost. But the best way to avoid liability expenses is to know and manage your specific business risks.

To minimize your coaching risks:

- Secure online platforms against data breaches to protect client information

- Document communication with clients (like emails, calls, and sessions)

- Ask clients to sign a contract or liability waiver with clear terms of service, payment policies, cancellation rules, and expectations

- Advise within the boundaries of your expertise — remember to respect the difference between life coaching and therapy

- Remove or point out obstacles and tripping hazards in your coaching space

Why Insurance Canopy for Life Coach Insurance?

Insurance Canopy offers the most comprehensive coverage for the most reasonable price in the business. But don’t take our word for it — check out how our Life Coach Insurance costs and coverages stack up against other top companies in this downloadable cost comparison chart.

- Affordable Monthly Payment Options

- Instance Certificate of Insurance (COI)

- 24/7 Policy Management Online

- Covered Anywhere You Coach

- U.S. Based, Licensed Agents Ready to Help

Life Coach Insurance Coverage

Insurance coverage types and policy limits:

The most your policy will pay for bodily injury and property damage claims occurring in the policies term that you become legally obligated to pay due to your business services.

$2,000,000

The maximum amount your policy will pay in a 12-month period for bodily injury and property damage claims that result from the products you use to perform your services. However, it does not cover your products that are sold or distributed.

$1,000,000

The amount that your policy will pay for claims arising out of one or more of the following offenses:

– False Arrest, detention or imprisonment

– Malicious prosecution

– Wrongful Eviction or Wrongful Entry

– Oral or written publications that slander or libels a person or organization

– Oral or written publication or material that violates a person’s right of privacy

– The use of another’s advertising idea in your advertisement

Included

The maximum amount paid per incident during the term of the policy.

$1,000,000

Applies to damage by fire to premises rented to the insured and to damage regardless of cause to premises (including contents) occupied by the insured for 7 days or less.

$300,000

Included

Optional Add-Ons

Financial coverage if you experience false allegations of sexual abuse, molestation, or misconduct.

$300,000

How Do I Get a Quote?

Get covered and back to inspiring your clients with our simple online application. It takes 10 minutes or less to get your quote — just answer a few questions about your coaching activities, add the extra coverages you want, and download your instant proof of insurance. It’s that easy.

Life Coach Insurance FAQs

What Kind of Insurance Do I Need As a Life Coach?

Life coaches need two types of liability insurance: one for their business risks, and one for their professional risks. General liability covers bodily injury and property damage claims your business might face, while professional liability (also called errors and omissions insurance) handles complaints against your coaching advice.

What Does Life Coach Insurance Typically Cover?

Life coach insurance covers you against harm your business or advice causes to third parties (like your client, or the owner of an office you rent).

Here are a few scenarios life coach insurance could cover:

- A client trips on the stairs and injures their knee leaving a coaching appointment. General liability or the medical expense limit in your policy could pay for their hospital bills and lost wages during recovery.

- You provide career advice that ends up costing your client money, and they sue you for their lost income. Professional liability insurance could cover legal expenses like settlements or damages.

- Following your advice didn’t have the outcome a client wanted, and they sue you for emotional damage. Court and representation fees still add up, even if you’re ultimately proven free of responsibility. Professional liability can shield you from paying legal fees out of pocket.

- A client spills their coffee all over the white carpet of your rented office space. General liability could help pay for patching or replacement.

What Are the Coverage Limits?

Life coach insurance from Insurance Canopy has a $1 million per occurrence limit and a $2 million yearly aggregate limit for general and professional liability claims. That’s one of the highest limits for the lowest price in the business. Start investing in your future security and success for just $21.08 a month. Need even higher limits? Upgrade our optional $3 million aggregate limit starting at $33.58/month.

How Often Should I Review and Adjust My Coverage?

We recommend reviewing your insurance policy to check that coverage still fits your business needs at least once a year. Just update your business address or add extra coverage online anytime through your customer portal. Need help? Call 844.520.6993 to ask our friendly and knowledgeable customer service agents.

JoAnne Hammer | Program Manager

JoAnne Hammer is the Program Manager for Insurance Canopy. She has held the prestigious Certified Insurance Counselor (CIC) designation since July 2004.

JoAnne understands that starting and operating a business takes a tremendous amount of time, dedication, and financial resources. She believes that insurance is the single best way to protect your investment, business, and personal assets.

JoAnne Hammer is the Program Manager for Insurance Canopy. She has held the prestigious Certified Insurance Counselor (CIC) designation since July 2004.

JoAnne understands that starting and operating a business takes a tremendous amount of time, dedication, and financial resources. She believes that insurance is the single best way to protect your investment, business, and personal assets.