Teacher Insurance Cost

How Much Does Teacher Insurance Cost?

Teacher insurance costs as little as $21.08/month or $229/ year with Insurance Canopy. This base policy covers the essentials every teacher needs, but you can also opt for extra coverage based on where and how you teach.

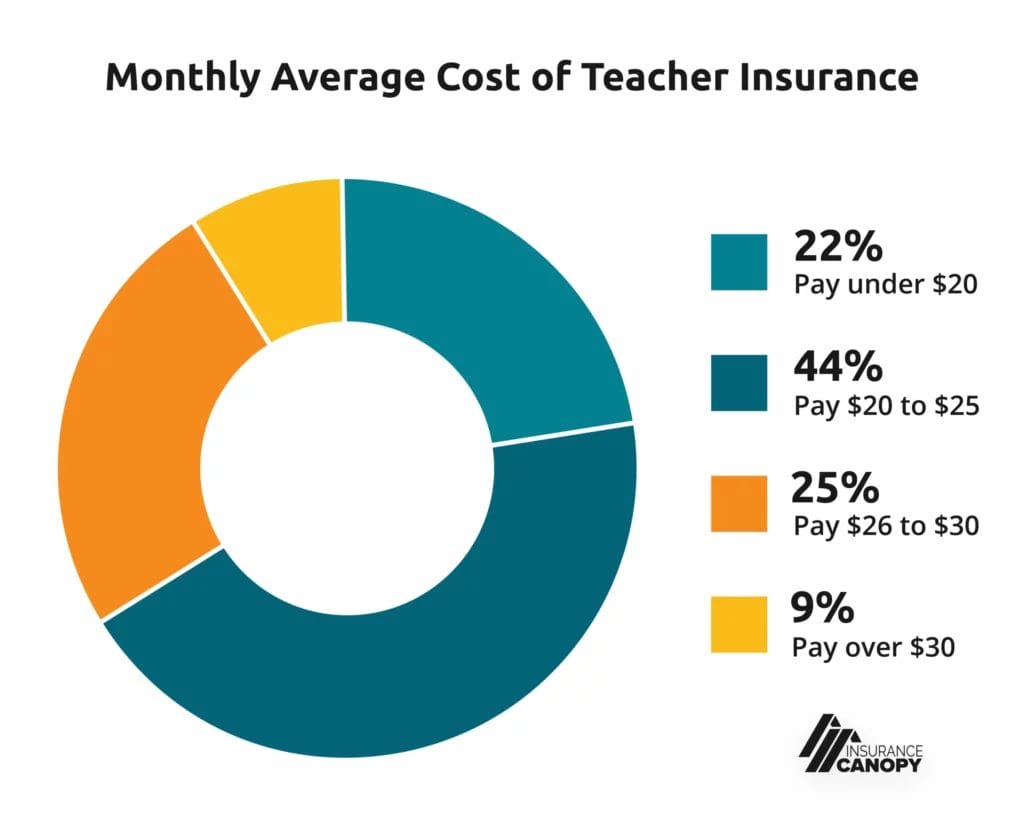

Most teachers pay $20 – $25 monthly. To see how those prices compare to other teacher insurance options at a glance, see our downloadable price comparison chart.

Your base policy includes the coverages needed to protect you from common claims, like trip and fall injuries, teaching mistakes, or complaints about your professional advice:

- General Liability

- Professional Liability (aka Errors and Omissions)

- Products-Completed Operations

- Damage to Premises Rented to You

- Personal and Advertising Injury

- Free and Unlimited Additional Insureds

We know teachers’ needs vary, so some of our coverages are optional to make sure you only pay for what you might use. Many of our policyholders choose to pay a little more to add one or both of these coverages to their policy:

- Equipment and Materials (Inland Marine Coverage) for $2.17 a month — our most popular add-on!

- Cyber Liability (Data Theft Coverage) for $8.25 a month

- Sexual Abuse and Molestation (SAM) Liability for $10.34+ a month

Note: This data is based on customer payments for both monthly and annual payment plans.

What Types of Payment Plans Are Available?

Insurance Canopy keeps payment flexible with monthly or annual payments to fit your calendar and budget.

- Monthly payments are good for lower prices now. Rather than paying all at once, you can break your premium into installments. Month-to-month coverage could also make sense if you teach seasonal classes, freelance, or don’t teach over the summer. There is a small $2 fee each month if you choose monthly payments.

- Annual payments are good for saving money over time. If you know you need coverage year-round, paying upfront with an annual plan saves you about 10% over the year. That translates to a month of LinkedIn Learning courses, a new headset for online teaching, or 24 crayon boxes – not too shabby.

How Much Does Each Type of Coverage Cost?

General Liability: $21.08 a Month or $229 a Year (Higher Limits Available)

This coverage can protect you from paying for injuries or property damage to a third party (like a student, parent, or facility owner) caused by your teaching activities or advice.

Your Insurance Canopy general liability coverage comes with professional liability, products-completed operations, damage to premises rented to you, and personal and advertising injury.

Our teacher insurance comes with $1 million per occurrence and $2 million per year of general and professional liability coverage. Need higher limits? We offer an optional higher $3 million aggregate limit starting at $33.58/month or $378/year.

Equipment and Materials: $2.17/Month

This optional coverage can pay to repair or replace damaged or stolen equipment. If you provide school supplies or let students use your tablets, phones, or computers, there is a strong possibility some will get accidentally broken or go missing.

Cyber Liability: $8.25/Month

Cyber attacks, including phishing, ransomware, and data breaches, happen more often than you think. If you store students’ data, like payment methods or contact info, cyber liability insurance can shield you from paying out-of-pocket to recover stolen data or defend yourself in a lawsuit.

Additional Insureds: FREE

An additional insured is a person or organization who requests to be added for coverage under your policy. This might be a company that hires you or the learning center facility manager. An additional insured on your policy gets shielded from paying out for claims if you make a mistake.

Sexual Abuse and Molestation Liability: Starting at $10.34/Month or $124/Year

Protect yourself against wrongful accusations of sexual harassment and other kinds of misconduct with SAM liability insurance. This coverage helps pay for your legal defense after a false allegation.

We customize your pricing to ensure you only pay for the protection limits you need. Get covered for as little as $10.34/month if you have $50,000 or less in gross annual teaching income. For educational corporations with $250,001+ in gross annual sales, rates max out at $37.83/month.

What Factors Affect Teacher Liability Insurance Cost?

Gross Annual Income

The higher your yearly income before taxes, the higher limits you need to properly shield those finances. This can increase the cost of your insurance.

Optional Coverages

Customizing your policy to fit your teaching with higher general liability limits, equipment coverage, or data theft protection increases your total price.

Claims History

If you have filed claims in the past, your insurance cost may be higher than if you did not have a history of filing claims.

Here’s a breakdown of how your gross annual income affects your insurance costs:

Teacher Liability Insurance Cost by Income

| Gross Annual Income | General Liability Premium | ||

|---|---|---|---|

Individual Teacher | |||

$0 – $50,000 |

$27.71 | ||

$50,001 – $100,000 |

$32.71 | ||

$100,001 – $150,000 |

$37.71 | ||

Educational Small Business Owner | |||

$0 – $50,000 |

$33.96 | ||

$50,001 – $100,000 |

$40.21 | ||

$100,001 – $150,000 |

$46.46 | ||

Can I Reduce the Cost of My Insurance?

Choosing an annual plan over monthly payments is one good way to manage your teacher insurance cost. Another strategy is to be aware of risks in your classroom and avoid common pitfalls.

Try these risk management strategies for teachers:

- Ask clients or students to sign written contracts and liability waivers that outline your terms of service, payment policies, cancellation policies, and expectations

- Inspect and maintain your teaching space on a regular schedule to check for and remove hazards

- Supervise students while they use expensive equipment and don’t leave students unattended

- Document lesson plans, students’ progress, grading rationale, and communication with students/parents

Staying on guard against risk lowers the chance that you’ll need to file a claim. A history of filing expensive claims can increase your premium, so maintaining a clean claims history (as much as possible) minimizes your insurance costs, too.

Why Insurance Canopy for Teacher Insurance?

Want to know if Insurance Canopy is the best deal to protect your teaching? We did the homework for you. Download our price comparison chart to see how our coverages and costs stack up against other popular teacher insurance policies.

- Affordable Monthly Payment Options

- No Association Membership Required

- For Public and Private Teachers

- Instance Certificate of Insurance (COI)

- 24/7 Policy Management Online

- Covered Anywhere You Teach

Teaching Insurance Coverage

Coverage types and limits included in liability insurance for educators:

The most your policy will pay for bodily injury and property damage claims occurring in the policies term that you become legally obligated to pay due to your business services.

$2,000,000

The maximum amount your policy will pay in a 12-month period for bodily injury and property damage claims that result from the products you use to perform your services. However, it does not cover your products that are sold or distributed.

$1,000,000

The amount that your policy will pay for claims arising out of one or more of the following offenses:

– False Arrest, detention or imprisonment

– Malicious prosecution

– Wrongful Eviction or Wrongful Entry

– Oral or written publications that slander or libels a person or organization

– Oral or written publication or material that violates a person’s right of privacy

– The use of another’s advertising idea in your advertisement

Included

The maximum amount paid per incident during the term of the policy.

$1,000,000

Applies to damage by fire to premises rented to the insured and to damage regardless of cause to premises (including contents) occupied by the insured for 7 days or less.

$300,000

Included

Optional Add-Ons

Financial coverage if you experience false allegations of sexual abuse, molestation, or misconduct.

$300,000

How Do I Get a Quote?

Get covered same-day for your teaching risks with our short and simple online application. Just tell us a little about your teaching activities, customize your coverages, and get your instant quote and proof of insurance. When we say simple, we mean it. The whole process takes 10 minutes or less.

Teacher Insurance Cost FAQs

Why Do I Need Teacher Insurance?

Teachers need teacher insurance, also called educators liability insurance, to stay off the hook financially for lawsuits. Even if your district, union, or professional organization has insurance, their coverage might not extend to you in every case. This is especially true for professional liability claims.

Say a student records and posts a snippet of your lesson, which sounds questionable out of context. Or you bump a student’s laptop during work time and knock it over. Your own teacher insurance policy can ensure you’re protected, even if your school’s coverage falls through or doesn’t apply.

What Types of Insurance Should Teachers Consider?

The most important insurance coverages for teachers are general and professional liability. If you buy your own school supplies or devices like a work laptop, equipment and supplies coverage can help with replacement or repair. Cyber liability insurance is a good choice for online teachers who store student information like credit card details and phone numbers.

What Does Teacher Insurance Typically Cover?

Teacher insurance can cover costly claims for the following risks:

- General liability: bodily injuries and property damage due to your teaching activities

- Example claim: A student trips and injures themselves in your classroom.

- Professional liability: harm due to your teaching services and advice

- Example claim: A student fails the state test you prepped them for, and the parents blame you.

- Equipment and supplies coverage: broken, damaged, or stolen gear and school supplies

- Example claim: A student you allowed to use your tablet during study hall accidentally drops and breaks it.

- Cyber liability: lawsuit costs due to cybercrimes like data breaches and phishing attacks

- Example claim: A cybercriminal hacks your laptop and steals your online students’ payment info.

What Does Professional Liability Insurance Cover for Teachers?

Professional liability insurance covers your performance of your job duties and your professional advice. It covers both in-person and online advice, so it’s a must-have wherever you teach. Common professional liability claims for teachers include negligence, teaching errors, and teaching omissions.

Do Student Teachers Need Insurance?

Yes! Some colleges require student teachers to get professional liability insurance for internships, practicums, and other teacher training programs. Student teachers have the same risks as professional instructors and can still be named in lawsuits.

JoAnne Hammer | Program Manager

JoAnne Hammer is the Program Manager for Insurance Canopy. She has held the prestigious Certified Insurance Counselor (CIC) designation since July 2004.

JoAnne understands that starting and operating a business takes a tremendous amount of time, dedication, and financial resources. She believes that insurance is the single best way to protect your investment, business, and personal assets.

JoAnne Hammer is the Program Manager for Insurance Canopy. She has held the prestigious Certified Insurance Counselor (CIC) designation since July 2004.

JoAnne understands that starting and operating a business takes a tremendous amount of time, dedication, and financial resources. She believes that insurance is the single best way to protect your investment, business, and personal assets.