Tutor Insurance Cost

How much does tutor insurance cost from Insurance Canopy? We’ve broken it down to help you make an educated decision and get the coverage you need at a price you can afford.

What Is the Cost of Tutor Insurance?

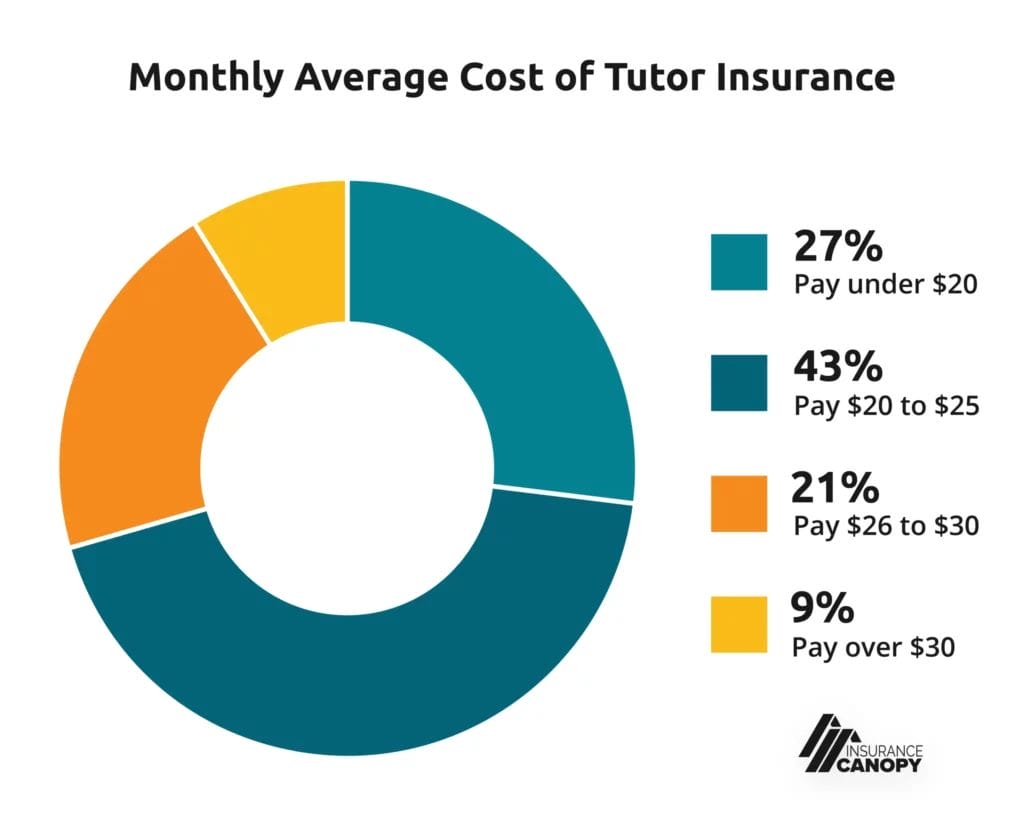

You can get tutor insurance for as low as $21.08 per month or $229 per year from Insurance Canopy. While that is the starting price, nearly half of our policyholders pay between $20 and $25 dollars per month.

Want to know more about how prices compare to other insurers? Check out our handy cost comparison chart and get the full picture.

With a base policy, you get the following fundamental coverages designed to protect you from common claims:

- General Liability

- Professional Liability (aka Errors and Omissions)

- Products-Completed Operations

- Damage to Premises Rented to You

- Personal and Advertising Injury

- Free and Unlimited Additional Insureds

Plus, you can customize your policy to suit your exact needs by purchasing additional coverage options, including:

- Cyber Liability (Data Theft Coverage) for $8.25 a month

- Equipment and Materials (Inland Marine Coverage) for $2.17 a month— our most popular add-on coverage!

- Sexual Abuse and Molestation (SAM) Liability for $10.34+ a month

Note: This data is based on customer payments for both monthly and annual payment plans.

What Types of Payment Plans Are Available?

Insurance Canopy gives you the flexibility to choose between monthly and annual payment plans according to what makes the most sense for your tutoring business and budget.

Monthly payments allow you to pay for your coverage in smaller installments throughout the year and give you more freedom to stop coverage when you don’t need it. For example, if you won’t be tutoring during summer vacation.

However, when you opt for annual payments, you save money over time. Even though you pay a larger sum upfront, there is a $2 fee for monthly payments that you avoid by choosing an annual plan. If you know you will need coverage for the entire year, annual payments are the more cost-effective option.

How Much Does Each Type of Coverage Cost?

General Liability: $21.08 a Month or $229 a Year (Higher Limits Available)

General liability coverage is designed to cover third-party bodily injury and property damage claims. When you purchase this coverage through Insurance Canopy, you also get products-completed operations, professional liability, personal and advertising injury, and damage to premises rented to you insurance.

Tutor insurance from Insurance Canopy comes with $1 million per occurrence and $2 million per year of general and professional liability coverage. Need higher limits to meet an insurance requirement? Upgrade to our optional $3 million aggregate limit starting at $33.58/month or $378/year

Equipment and Materials: $2.17/Month

From laptops to textbooks, you rely on a variety of equipment to conduct tutoring sessions. If a student spills a glass of water all over your tablet, this coverage could pay to repair or replace it.

Cyber Liability: $8.25/Month

Data breaches, phishing, and other cybercrimes are an unfortunately common occurrence these days. If you store any sensitive information digitally, whether that includes your students’ payment information or your own financial records, you need cyber liability insurance.

This coverage is designed to shield you from paying out of pocket to recover lost or stolen data or for legal fees if a student sues you over their compromised information.

Additional Insureds: FREE

Additional insureds are people or organizations that may request to be added to your policy in order to shield themselves from your liability. They typically include landlords or employers who hire you as a contractor.

Insurance Canopy makes it easy to add an unlimited number of additional insureds whenever you need to from your online user dashboard, totally free of charge.

Sexual Abuse and Molestation Liability: Starting at $10.34/Month or $124/Year

Protect yourself against wrongful accusations of sexual harassment and other kinds of misconduct with SAM liability insurance. This coverage helps pay for your legal defense after a false allegation.

We make sure your price reflects the limits you truly need. Tutors who make $50,000 or less annually from teaching can get coverage for as low as $10.34/month, while tutoring corporations with $250,001+ in gross annual sales may pay a maximum of $37.83/month.

What Factors Affect the Cost of Tutor Insurance?

Gross Annual Income

When you have higher gross annual income, you also need higher limits to sufficiently protect your finances.

Optional Coverages

Choosing a higher general liability limit or including optional add-on coverages to shield you from data breaches or equipment theft can raise your premium cost.

Claims History

Sometimes a history of filing claims can raise the cost of your insurance premium because you pose a greater risk to the insurance carrier.

Here’s a breakdown of how your gross annual income affects your insurance costs:

Tutor Insurance Cost by Income

| Gross Annual Income | General Liability Premium | ||

|---|---|---|---|

Individual Tutor | |||

$0 – $50,000 |

$27.71 | ||

$50,001 – $100,000 |

$32.71 | ||

$100,001 – $150,000 |

$37.71 | ||

Tutoring Small Business Owner | |||

$0 – $50,000 |

$33.96 | ||

$50,001 – $100,000 |

$40.21 | ||

$100,001 – $150,000 |

$46.46 | ||

Can I Reduce My Tutor Insurance Cost?

Risk management is the best way to keep the cost of your tutor insurance premium as low as possible.

While it isn’t possible to avoid all accidents, many of the most common ones tutors face are preventable. By managing your risks, you keep your claims history clean and can avoid having to pay higher premiums as a result.

Start incorporating the following risk-mitigating strategies for tutors into your practice today:

- Maintain a clear and clutter-free teaching environment to avoid trip-and-fall hazards

- Always supervise students while they are using your teaching equipment and materials

- Keep organized records of lesson plans, your students’ progress, and any communication you have with your students and/or their parents

- Create a contract for your students and/or their parents to sign that clearly outlines your expectations, including payment policies, cancellation policies, and terms of service

Why Insurance Canopy for Life Coach Insurance?

With Insurance Canopy, you get comprehensive coverage for a competitively low price. For more information on how our tutor insurance compares with other options on the market, download our cost comparison chart.

- Affordable Monthly Payment Options

- For In-Person and Remote Tutors

- Instant Certificate of Insurance (COI)

- A+ Rated Coverage

- Covered Wherever You Tutor

Tutor Liability Insurance Coverage

Insurance coverage types and policy limits:

The most your policy will pay for bodily injury and property damage claims occurring in the policies term that you become legally obligated to pay due to your business services.

$2,000,000

The maximum amount your policy will pay in a 12-month period for bodily injury and property damage claims that result from the products you use to perform your services. However, it does not cover your products that are sold or distributed.

$1,000,000

The amount that your policy will pay for claims arising out of one or more of the following offenses:

– False Arrest, detention or imprisonment

– Malicious prosecution

– Wrongful Eviction or Wrongful Entry

– Oral or written publications that slander or libels a person or organization

– Oral or written publication or material that violates a person’s right of privacy

– The use of another’s advertising idea in your advertisement

Included

The maximum amount paid per incident during the term of the policy.

$1,000,000

Applies to damage by fire to premises rented to the insured and to damage regardless of cause to premises (including contents) occupied by the insured for 7 days or less.

$300,000

Included

Optional Add-Ons

Financial coverage if you experience false allegations of sexual abuse, molestation, or misconduct.

$300,000

How Do I Get a Quote?

Getting a quote from Insurance Canopy is as easy as 1-2-3! Just answer a few questions about your tutoring business, select the coverages you want, and receive your free quote in 10 minutes or less — all through our 100% online application!

Frequently Asked Questions

Does Tutor Insurance Cover Remote or Virtual Tutors?

Yes! Whether you tutor virtually, in person, or do a combination of both, our policy can shield you from paying out of pocket for common claims.

What Coverage Limits Do I Need for My Tutor Insurance Policy?

Consider the following to decide what coverage limits you need:

- The replacement costs of all equipment and materials you use for tutoring (laptop, tablet, workbooks, etc.)

- Whether you have any contractual obligations that require you to have certain coverage limits

- Determine what potential liability scenarios you may face (student injury, property damage, professional negligence, etc.) by conducting a risk assessment

What Limits Does Insurance Canopy Offer?

Our general liability policy has a $1,000,000 occurrence limit and a $2,000,000 aggregate limit and starts at $21.08/month. If you need more coverage, you can upgrade to a $3 million aggregate limit for as little as $33.58/month. If you need higher limits, please contact our team of licensed customer service agents at 844.520.6993 — they are happy to help!

Does the Cost of Tutor Insurance Include Coverage for Teaching Equipment?

No, your teaching equipment is not covered by a base tutor insurance policy. However, you can add this coverage to your policy by selecting inland marine (equipment and materials) coverage during checkout. This insurance costs $2.17 a month and includes up to $2,000 in coverage per claim and $4,000 for the year.

JoAnne Hammer | Program Manager

JoAnne Hammer is the Program Manager for Insurance Canopy. She has held the prestigious Certified Insurance Counselor (CIC) designation since July 2004.

JoAnne understands that starting and operating a business takes a tremendous amount of time, dedication, and financial resources. She believes that insurance is the single best way to protect your investment, business, and personal assets.

JoAnne Hammer is the Program Manager for Insurance Canopy. She has held the prestigious Certified Insurance Counselor (CIC) designation since July 2004.

JoAnne understands that starting and operating a business takes a tremendous amount of time, dedication, and financial resources. She believes that insurance is the single best way to protect your investment, business, and personal assets.