Yoga Insurance Cost

See how much you can expect to pay for top-rated coverage with our yoga liability insurance cost breakdown.

JoAnne Hammer is the Program Manager for Insurance Canopy. She has held the prestigious Certified Insurance Counselor (CIC) designation since July 2004.

JoAnne understands that starting and operating a business takes a tremendous amount of time, dedication, and financial resources. She believes that insurance is the single best way to protect your investment, business, and personal assets.

JoAnne Hammer | Program Manager

JoAnne Hammer is the Program Manager for Insurance Canopy. She has held the prestigious Certified Insurance Counselor (CIC) designation since July 2004.

JoAnne understands that starting and operating a business takes a tremendous amount of time, dedication, and financial resources. She believes that insurance is the single best way to protect your investment, business, and personal assets.

How Much Does Yoga Teacher Insurance Cost?

Yoga teacher insurance costs as little as $15 per month or $159 per year with Insurance Canopy.

These prices represent our base policy, which includes both general and professional liability and covers the common claims yoga instructors face. Our customizable insurance lets you add extra coverage easily — pay only for what you need!

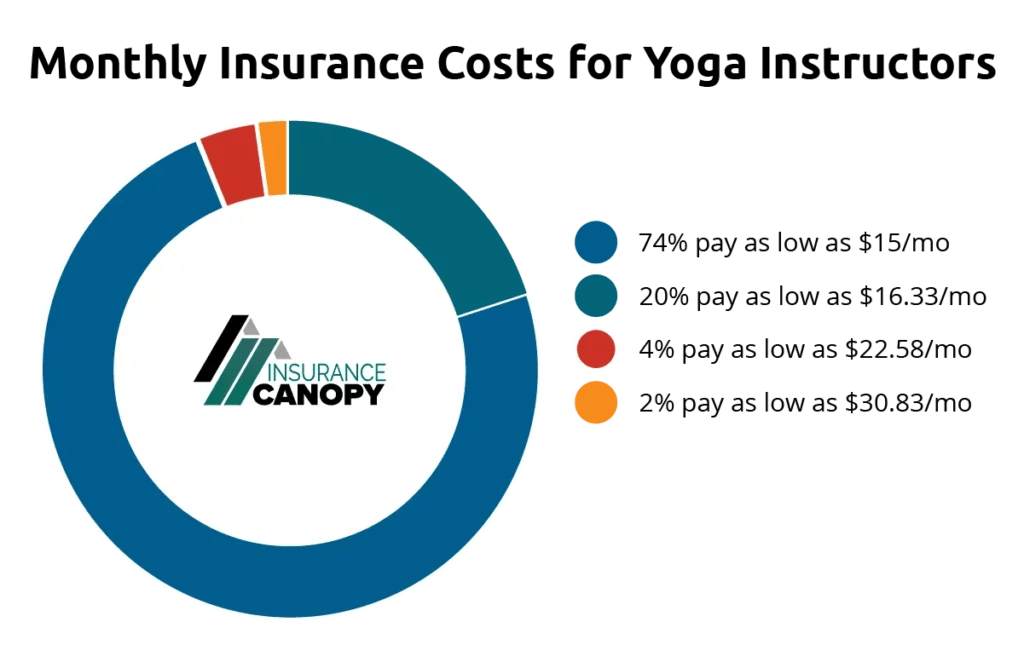

Here is what our policyholders pay on average:

Note: based on Insurance Canopy yoga instructor data from November 2024

Base Policy

The majority of yoga instructors (74%) covered by Insurance Canopy opt for our base policy only. Its essential coverage includes:

Available Add-On Coverages

26% of our policyholders modify their base policy to their needs with add-on coverages, including:

- Gear and Equipment (Inland Marine) Coverage

- Additional Insureds

- Diet or Nutrition Coverage

- Cyber Liability (Data Theft) Coverage

- Sexual Abuse & Molestation (SAM) Insurance (+$10.33/month)

Insurance Canopy supports your practice by offering the industry’s cheapest yoga insurance that balances excellent-rated protection with affordability.

Pro Tip: Save nearly 12% by choosing an annual payment plan. Your base policy amounts to $13.25/month if you make one payment of $159 for the whole year!

How Much Does Each Type of Coverage in a Yoga Teacher Insurance Policy Cost?

What Factors Affect Yoga Teacher Insurance Cost?

Your total yoga teacher insurance cost will be determined by the payment plan (monthly or yearly) and the add-on coverages you choose.

Insurance Canopy offers a set premium rate for yoga instructors so you can feel aligned on exactly what you’re paying for! Other insurance companies might factor in your teaching style, location, additional services, claims history, and limit averages to calculate your premium cost.

As long as you qualify for the yoga instructor policy with Insurance Canopy, you can enjoy cheap yoga insurance without compromising reliable coverage.

You qualify for our yoga teacher insurance if you:

- Don’t offer instruction under any of our three excluded classes

- Martial arts (like MMA or judo)

- Aerial sports (like aerial yoga or pole dance)

- Water fitness (like swim coaching or water aerobics)

- Live and teach within the U.S. (we currently don’t sell policies in Missouri)

- Do not have any prior claims

- Have earned any certifications or licenses required by your state or local government

Can I Reduce the Cost of My Insurance?

Insurance Canopy’s yoga instructor coverage is crafted with intention — you can be sure you’re getting the lowest rates for high-quality protection.

Here are a few ways to reduce your business costs even further.

Pay Upfront

Rather than paying a total of $180 a year with $15 monthly payments, you can save $21 by making one annual payment of $159 at the beginning of your policy year.

Consider Your Additional Coverages

Lower the cost of your insurance by being selective about which add-ons you opt for. For example, if you teach yoga at more than two studios, you’ll save by choosing unlimited additional insureds ($30) versus paying individually ($15).

Reduce Your Risks

Lower the chances of potential claims by providing safe yoga instruction and staying aware before, during, and after classes.

- Complete regular risk assessments.

- Check in with students and offer modifications if necessary.

- Stay updated on continuing education (CE) and yoga instructor certification.

- Have students sign yoga liability waivers before beginning their practice.

Why Insurance Canopy for Low-Cost Yoga Liability Insurance?

- General and Professional Liability Coverage

- Customizable Policy

- Monthly and Yearly Payment Options

- Coverage for 100+ Teaching Styles

- 24/7 Online Access

- Instant Certificate of Insurance

- Fast Online Quote Process

- Online and Multi-Location Coverage

- Occurrence-Based Policy*

- Free Additional Resources

- Plus Much More!

*All customers who purchased a policy before 7/1/2024 will have a policy issued through Great American Insurance. This policy does not include occurrence form coverage and will be eligible to receive it after 7/1/2025.

Coverage Details

General & Professional Liability Limits

$3,000,000

$3,000,000

The amount your policy will pay for claims arising out of one or more of the following offenses:

– False Arrest, detention or imprisonment

– Malicious prosecution

– Wrongful Eviction or Wrongful Entry

– Oral or written publications that slander or libels a person or organization

– Oral or written publication or material that violates a person’s right of privacy

– The use of another’s advertising idea in your advertisement

Included

The maximum the insurance carrier will pay for a bodily injury or property damage claim that you become legally obligated to pay due to your business and professional services.

$2,000,000

Applies to damage by fire to premises rented to the insured and to damage regardless of cause to premises (including contents) occupied by the insured for 7 days or less.

$300,000

$5,000

The amount we deduct from a claim before paying up to your policy limits.

$0

Optional Add-Ons

Price

$1.33–$5.55/month

The maximum amount paid out in the case of a cyber attack on your business. Because this coverage is not automatically included in the standard General Liability Policy, you will need to opt into this coverage. See the application for additional coverage details for Cyber Liability Insurance.

$8.25/month

$6.83/month

Coverage for a third party, such as a business, property owner, event organizer, or employer who could be named in a claim arising from your business operations. It cannot be used for employees, friends or family, other trainers, yourself, or other businesses you may own. Add one additional insured for $15, or choose unlimited additional insureds for $30.

$15–$30/year

Coverage for defense costs if you’re wrongly accused of sexual harassment or improper conduct.

$10.33/month

How Do I Get a Yoga Insurance Quote?

Get insured online in minutes.

- Select “yoga instructor” coverage.

- Customize your policy.

- Tell us about your business.

- See your instant quote in the app — we’ll email it to you too!

From there, you can buy your policy in just a few clicks and get your proof of insurance.

FAQs About Yoga Insurance Costs

Is Yoga Insurance Necessary?

Yes, you need yoga insurance! It’s a cost-effective way to protect your business financially in case a student gets injured in your class, damages property, or is dissatisfied with your instruction.

Plus, most studios will require you to carry liability insurance as a condition for employment. Getting the right coverage ensures you can focus on helping students in their yoga journeys — not on risks associated with your work.

Does the Cost of Yoga Insurance Cover Retreats?

Yes, your Insurance Canopy policy covers you when you teach yoga at retreats and workshops across the U.S. Your coverage goes with you wherever you work.

Are There Specific Policies for Part-Time or Student Instruction?

Our flat-rate yoga insurance protects you whether you’re a student, part-time teacher, or full-time teacher. So no matter what stage you’re at in your yoga career, our yoga instructor policy grows with you and keeps you safe from common claims for an affordable price.