Music Teacher Insurance Cost

Considering coverage but wondering how much music teacher insurance costs? With Insurance Canopy, you can get top-rated coverage for an affordable price and never miss a beat if an accident happens.

What Is the Cost of Music Teacher Insurance?

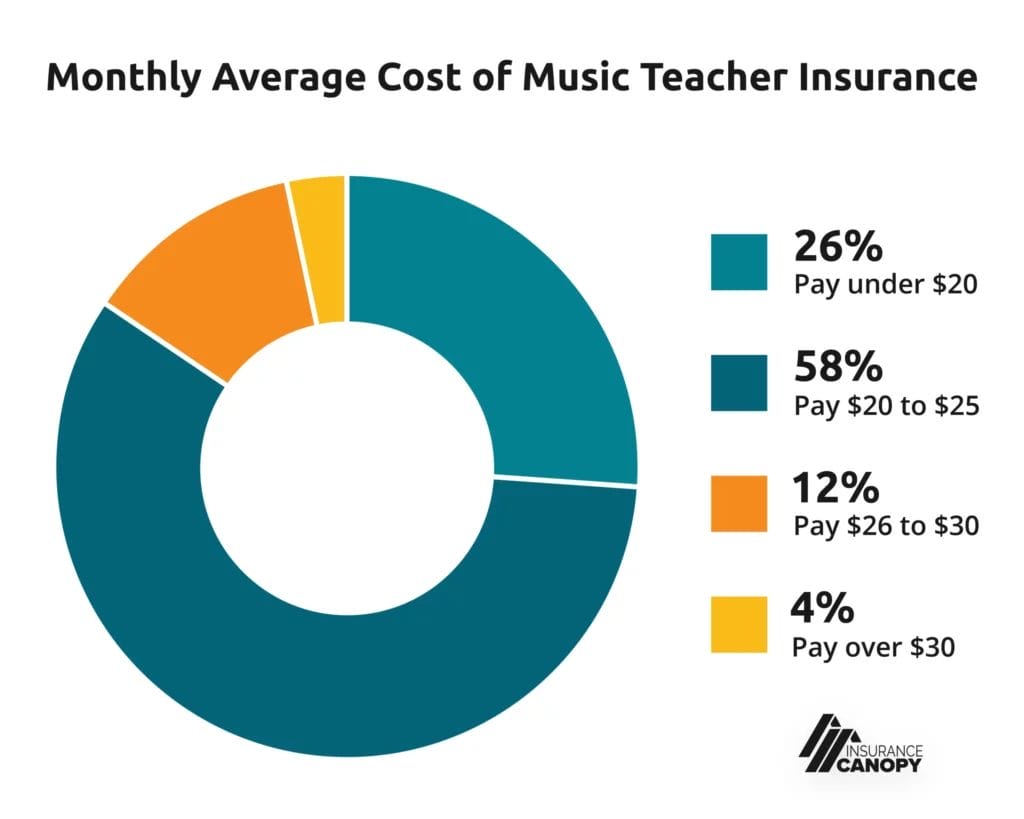

Music teacher insurance can cost as low as $21.08 per month or $229 for a year of coverage when you purchase a base policy from Insurance Canopy. On average, our customers pay between $20 and $25 per month.

Curious to see how our prices compare to other insurance options on the market? Our cost comparison chart breaks it all down for you.

Our base policy includes the following essential coverages to shield your business from financial losses:

- General Liability

- Professional Liability (aka Errors and Omissions)

- Products-Completed Operations

- Damage to Premises Rented to You

- Personal and Advertising Injury

- Free and Unlimited Additional Insureds

However, like many other music teachers, you might want additional coverage to shield your business and finances. With Insurance Canopy, you can easily add extra coverages to your policy for an added cost, including:

- Inland Marine (Instruments and Equipment) for $2.17 a month — our most popular add-on!

- Cyber Liability (Data Breach Coverage) for $8.25 a month

- Sexual Abuse and Molestation (SAM) Liability for $10.34+ a month

Note: This data is based on customer payments for both monthly and annual payment plans.

What Types of Payment Plans Are Available?

With Insurance Canopy’s flexible payment plans, you can choose between monthly and annual payments depending on what’s best for your career and your budget.

Monthly payments are a convenient way to pay for your coverage incrementally throughout the year or to stop coverage if you don’t need it, like if you aren’t teaching over summer break.

On the other hand, annual payments cost more upfront but allow you to save money over time. There is a recurring $2 fee for monthly payments, so if you know you’ll need coverage for a full year you can ultimately pay less by opting for an annual payment instead.

How Much Does Each Type of Coverage Cost?

General Liability: $21.08 a Month or $229 a Year (Higher Limits Available)

If you cause bodily injury or property damage to a third party, this coverage can shield you from the cost of that claim. At Insurance Canopy, your general liability coverage also includes professional liability, products-completed operations, damage to premises rented to you, and personal and advertising injury insurance.

Insurance Canopy’s music teacher insurance comes with $1 million per occurrence and $2 million per year of general and professional liability coverage. Looking for more coverage? Upgrading to our optional $3 million aggregate limit (starting at $33.58/month or $378/year) helps your protection scale with your growing studio.

Equipment and Materials: $2.17/Month

This optional coverage can cover the cost of damaged or stolen equipment. If a student knocks your guitar off its stand and it breaks, you could receive coverage to replace it.

Cyber Liability: $8.25/Month

Cybercrimes like phishing, ransomware, and data breaches are common occurrences. If you store your students’ data electronically, such as their payment information, cyber liability insurance can shield you from the cost of recovering that data if it’s stolen or defending yourself if your student sues you.

Additional Insureds: FREE

An additional insured is a person or an organization that is not automatically included under your policy, but might request that you add them. Typically, this includes landlords and people or organizations that contractually hire you. They may request additional insured status on your policy to shield them from paying out for a claim if you do something wrong.

Sexual Abuse and Molestation Liability: Starting at $10.34/Month or $124/Year

Protect yourself against wrongful accusations of sexual harassment and other kinds of misconduct with SAM liability insurance. This coverage helps pay for your legal defense after a false allegation.

More students equal more risk, so we adjust your limits to make sure you only pay for what you need.Teachers who make $500,000 or less in gross annual teaching income can get coverage for as little as $10.34/month. For larger educational corporations with over $250,001 in gross annual sales, prices max out $37.83/month.

What Factors Affect the Cost of Liability Insurance for Music Teachers?

Gross Annual Income

Higher gross annual income means you’ll need higher limits to properly shield your business. This can increase the cost of your premium.

Optional Coverages

You can add higher limits or extra coverages to your policy to protect against equipment theft or a data breach for a little more.

Claims History

If you have filed claims in the past, your insurance premium may be higher than if you did not have a history of filing claims.

Music Teacher Insurance Cost by Income

| Gross Annual Income | General Liability Premium | ||

|---|---|---|---|

Individual Music Teacher | |||

$0 – $50,000 |

$27.71 | ||

$50,001 – $100,000 |

$32.71 | ||

$100,001 – $150,000 |

$37.71 | ||

Music Teacher Small Business Owner | |||

$0 – $50,000 |

$33.96 | ||

$50,001 – $100,000 |

$40.21 | ||

$100,001 – $150,000 |

$46.46 | ||

Can I Reduce the Cost of My Insurance?

The best thing you can do to keep your premiums as low as possible is to incorporate proven risk management strategies into your teaching practice.

This could include:

- Using clear, written contracts to outline your terms of service, payment policies, cancellation policies, and expectations

- Regularly inspecting and maintaining your teaching space to ensure it’s free from hazards

- Supervising your students and not leaving them unattended with your instruments and equipment

- Keeping detailed documentation of lesson plans, student progress, and communications with students/parents

By managing your risks, you decrease the chances of needing to file a claim. Having a history of filing expensive claims can increase your premium, so keeping your claims history as clean as possible is the best way to keep costs down.

Why Insurance Canopy for Music Teacher Insurance?

Insurance Canopy offers some of the most affordable music teacher insurance in the business without skimping on coverage. Download our price comparison chart and see for yourself how our coverage and costs measure up to other insurance companies.

- Affordable Monthly Payment Options

- No Association Membership Required

- For Public and Private Music Teachers

- Instance Certificate of Insurance (COI)

- A+ Rated Coverage

- Covered Anywhere You Teach

Music Teacher Insurance Coverage

Coverage types and limits included in liability insurance for educators:

The most your policy will pay for bodily injury and property damage claims occurring in the policies term that you become legally obligated to pay due to your business services.

$2,000,000

The maximum amount your policy will pay in a 12-month period for bodily injury and property damage claims that result from the products you use to perform your services. However, it does not cover your products that are sold or distributed.

$1,000,000

The amount that your policy will pay for claims arising out of one or more of the following offenses:

– False Arrest, detention or imprisonment

– Malicious prosecution

– Wrongful Eviction or Wrongful Entry

– Oral or written publications that slander or libels a person or organization

– Oral or written publication or material that violates a person’s right of privacy

– The use of another’s advertising idea in your advertisement

Included

The maximum amount paid per incident during the term of the policy.

$1,000,000

Applies to damage by fire to premises rented to the insured and to damage regardless of cause to premises (including contents) occupied by the insured for 7 days or less.

$300,000

Included

Optional Add-Ons

Financial coverage if you experience false allegations of sexual abuse, molestation, or misconduct.

$300,000

How Do I Get a Quote?

You can get your free quote today with our 100% online application process! Simply tell us a little bit about your music teaching business, select the coverages you want, and receive your quote in 10 minutes or less.

Frequently Asked Questions

Does Music Teacher Insurance Cost More for Private Music Teachers Than for Those Employed by Schools?

There is no difference between the cost of insurance for a private music teacher and a music teacher employed by a public school. Your employer is not one of the factors that could increase the cost of your premium.

Do Music Teachers Need Both General and Professional Liability Insurance?

Yes! These two types of coverage respond to different claims, so it’s important to have both. General liability covers third-party bodily injury and property damage claims, whereas professional liability can shield you if a student claims you gave them bad instruction that caused them to fail a university entrance exam.

A base policy from Insurance Canopy includes both general and professional liability insurance, so you don’t have to worry about purchasing multiple policies to get the coverage you need.

Does the Cost of Music Teacher Insurance Include Coverage for Music Instruments?

No, musical instruments are not covered in a base music teacher insurance policy. To get coverage for your instruments and other business personal property (laptops, tablets, etc.), you can add equipment and materials coverage to your policy during checkout for just $2.17 per month. This includes coverage for claims up to $2,000 per occurrence and $4,000 for the year.

What Are the Coverage Limits I Should Consider for My Insurance Policy?

Before buying a policy, consider whether the aggregate and per-occurrence limits, as well as the coverages included in that policy, are sufficient enough to protect your business.

Conduct a risk assessment of your teaching business to determine what your potential liabilities are, such as property damage, injury to your students, and professional negligence. Calculate the replacement cost of your instruments and teaching materials and review any contractual obligations you have that might require certain coverage limits.

Most general liability policies have an occurrence limit between $1 million and $2 million, with an aggregate limit between $2 million and $4 million. Insurance Canopy’s music teacher insurance comes with an occurrence limit of $1 million and an aggregate limit of $2 million. As your studio grows, you can upgrade to our higher $3 million aggregate limit for extra coverage.

JoAnne Hammer | Program Manager

JoAnne Hammer is the Program Manager for Insurance Canopy. She has held the prestigious Certified Insurance Counselor (CIC) designation since July 2004.

JoAnne understands that starting and operating a business takes a tremendous amount of time, dedication, and financial resources. She believes that insurance is the single best way to protect your investment, business, and personal assets.

JoAnne Hammer is the Program Manager for Insurance Canopy. She has held the prestigious Certified Insurance Counselor (CIC) designation since July 2004.

JoAnne understands that starting and operating a business takes a tremendous amount of time, dedication, and financial resources. She believes that insurance is the single best way to protect your investment, business, and personal assets.